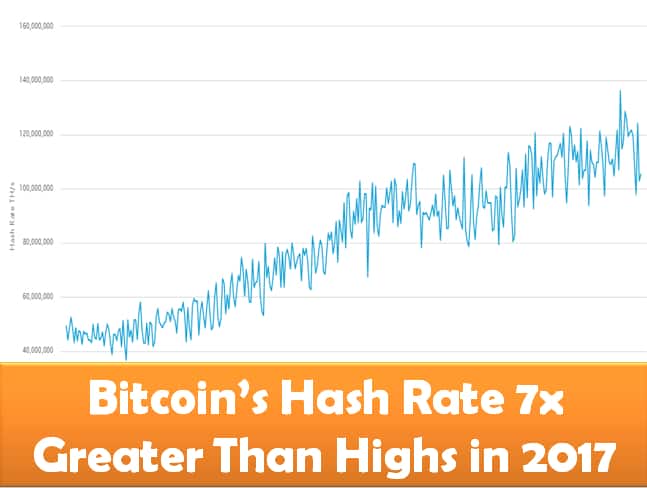

Bitcoin Hash Rate 7x Greater Than During Highs in 2017

Last updated on November 1st, 2022 at 01:50 pm

Although the price of Bitcoin is still showing signs of consolidation, its fundamentals are still doing very great until now.

Data shows that Bitcoin’s hash rate is seven times more than its level when BTC reached its all-time high price in December 2017.

In a recent tweet by a bitcoin trader, who is known as Rhythm said the hash rate is overwhelmingly larger than Bitcoin’s price momentum.

In December 2017, when the Bitcoin price was pushing to $20k, its hash rate was even going higher to 14,600,000 tera hashes per second (14.6 EH/s). But the Bitcoin hash rate has been fluctuating at an average of 94 million TH/s for days now.

The upward movement of the hash rate has slowed down pace over the past few months.

However, when compared with the yearly rate from January last year, the hash rate has actually risen to a great extent. After a little dip in growth towards the end of 2018, it has been averaging more than 40 EH/s since then.

In September last year, the level reached an unprecedented high of 100 EH/s. It almost reached the 120 mark towards the end of October.

Tying Bitcoin’s Hash Rate To Price

In most cases, the price of Bitcoin is not dependent on its level of the hash rate at that time. The price does not go according to the hash rate directly. However, there are some linking factors that can determine its price to some extent. In other words, the price of Bitcoin could alter a bit as a result of the number of hash rates it has received.

When the price of Bitcoin falls, it could somehow result in a fall of the hash rate. A typical scenario is taken when some miners begin to resign their fate as the mining profitability falls. Some traders believe that sometimes when Bitcoin falls, it’s an indication that the serious players in the market are trying to shake off weak hands. This would normally not have any impact on the price or hash rate.

Hash Rate Sometimes Taken Into Consideration

Analysts are always looking for several indices before attempting to predict the movement of Bitcoin and the change in hash rate is sometimes considered. However, its consideration is usually on a lower key compared to other major indices. Some analysts also consider Bitcoin’s difficulty adjustment pattern when predicting future price moves.

Hash Rate Spikes Are a Direct Impact of Miners

The high levels of the BTC hash rate have been blamed on the increased number of miners who are looking to expand their mining of Bitcoin. It’s also a result of the increasing numbers of powerful ASIC miners in the industry. When there is a higher hash rate, it means that there is also an increased mining difficulty, which is good for blockchain security.

As the market has proven, a reduced supply of Bitcoin, as well as increased mining difficulty, usually produces a bullish movement in the market. Some analysts are of the opinion that the market should be more enthusiastic because of the possibility of the higher difficulty adjustment that is coming soon.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page