Biden’s Crypto Executive Order

Last updated on October 31st, 2022 at 11:36 pm

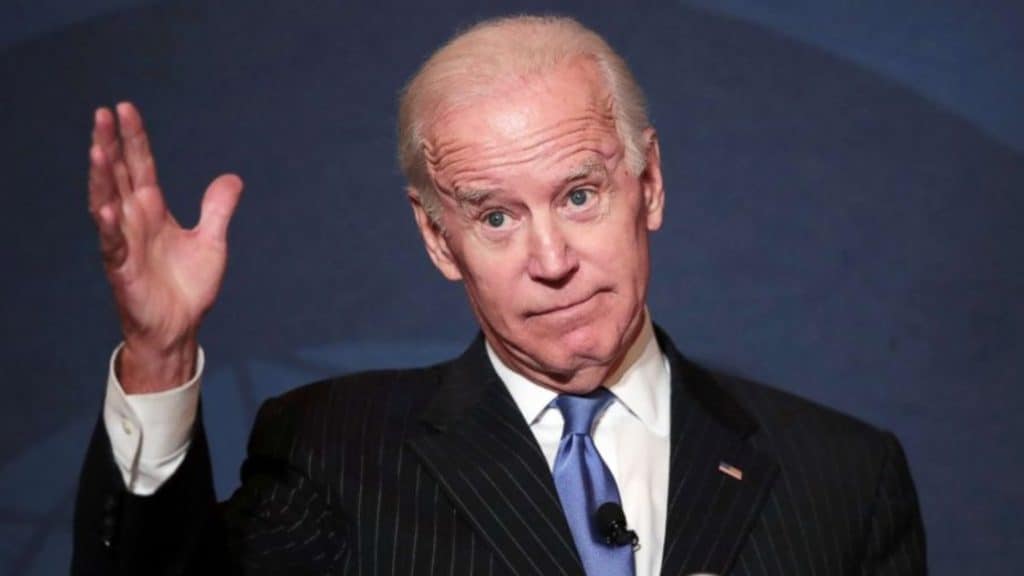

On Wednesday, President Joe Biden issued an executive order directing the federal government to begin developing policy for digital assets, including cryptocurrencies, that encourages innovation whilst reducing dangers to consumers, investors and the global financial system.

The details of the executive order were a pleasant surprise to the crypto community, many of whom were expecting more of a crackdown on crypto, the nature of the executive order sent the price of bitcoin up to $42.5K.

Because the crypto industry has grown so rapidly, the administration is closely monitoring the threats that cryptocurrencies pose to investors, consumers and financial stability.

The executive order has instructed the Financial Stability Oversight Council (FSOC), which was established after the 2008 global financial crisis, to monitor the possible financial system risks and determine what systemic concerns digital assets represent.

‘Birth’ of U.S. CBDC

One of the most interesting parts of the order was the urging of the Federal Reserve to research and possibly create its own digital currency, which would be just like existing cryptocurrencies.

The U.S. Treasury is leading the majority of the studies, which are set to last between 60 and 180 days each on average. This has given us a rough idea what the government’s intentions are, but how they translate those intentions into legislation is still left open.

One report that the agency is in charge of is regarding the future of payments and money. The issuing of a Central Bank Digital Currency (CBDC) is a topic that the administration is expected to investigate thoroughly. As of this writing, the Fed has completed the first testing phase of a CBDC.

One of the major issues being raised include how a digital dollar will interact with stablecoins and other privately produced digital assets, as well as how they relate to the dollar’s overall strategic position and the interaction between digital and fiat assets.

Central Banking Digital Currencies will be explored for use in real-time payments, according to senior administration officials, as well as the possibilities for alternative payment options.

FedNow, the Federal Reserve’s upcoming real-time payment system, will allow individuals and companies to transfer payments instantly beginning in 2023, this could be an ideal test case.

Other CBDCs

According to Chris Giancarlo, who is also the co-founder of the Digital Dollar Project, which has looked into the relationship between societal values and CBDCs,

“One future might be retail payments are done through commercially operated stablecoins and wholesale through the FedNow payment system,”

While other countries, such as China, promote their own digital currencies, Giancarlo has pushed for the United States to take the lead in CBDCs.

Another major topic officials are considering is the interoperability of a U.S. CBDC with international counterparts and how it would be structured. Officials claim that there are also some private and multi-central bank projects looking towards CBDC clearance and interoperability.

Given that the U.S. dollar is the main reserve currency and crucial to the global financial system, officials are considering how a U.S. token would interact with the global economy if the U.S. adopts a CBDC.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page