Coinbase Launches Crypto Debit Card for U.S.

Last updated on November 1st, 2022 at 01:32 am

Cryptocurrency debit cards can make the mainstream adoption and use of cryptocurrency a reality in today’s world. We have seen more and more crypto debit options during the course of 2020.

We’ve reported on many of these offerings across the globe. Some of these include Crypto.com launching debit cards in 31 EU nations and Binance launching crypto debit cards in the EU & UK.

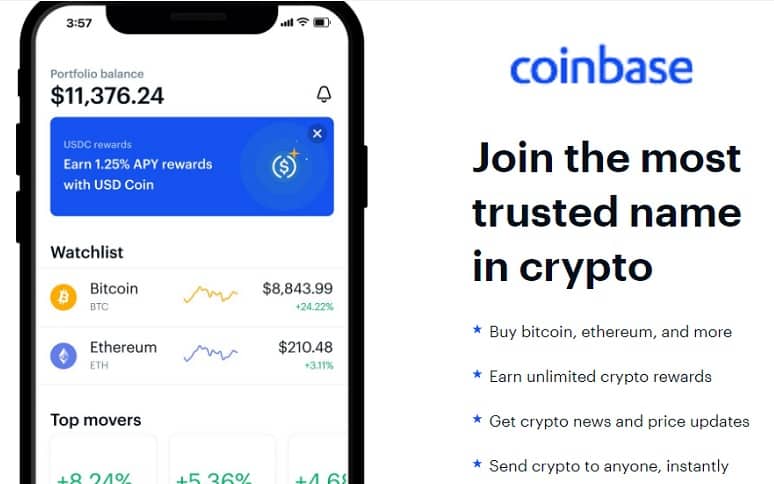

Now another popular company in the cryptocurrency space has joined the ranks of making crypto debit cards available to U.S. residents. Top crypto exchange Coinbase, announced on October 28th that it is rolling out a debit card for users located in the United States.

It wasn’t that long ago that Coinbase announced a partnership with Visa. Not to mention that Coinbase already launched a card in the UK and Europe. Now U.S. customers have been asked to join the waitlist pending when they receive their cards.

Get Your Coinbase Debit Card Here

Use Anywhere Visa is Accepted

According to the announcement, the card will be used like any other Visa debit card. It will be accepted across all ATM and web platforms, just like a traditional Visa card.

This launch will allow users to spend their cryptocurrency directly from their Coinbase accounts. Whenever a user wants to spend with the card, the designated cryptocurrency is immediately converted to U.S. dollars, allowing for seamless use of the card.

Reward Program Available

To facilitate massive adoption and card application, Coinbase is launching a rewards program for the new card.

The reward program gives back 1% to the users when they spend Bitcoin (BTC) or 4% when they spend Steller Lumens (XLM).

However, the promotion is only valid in the U.S. It’s a strategy of the company to encourage users to spend or make crypto purchases using their Coinbase accounts.

No one is required to pay to get the card and users will pay a small fee when they choose to spend with Coinbase’s USDC stablecoin.

U.S. Card Different From Coinbase Europe Card

There are some differences between Coinbase’s card offered in Europe and the new one released for U.S. residents.

For instance, U.S. customers can transact and manage their cards directly through the Coinbase app. In the U.K. and Europe, the exchange uses a separate app to manage the card.

Also, while users in Europe are limited to spending only a smaller coin list on the card, users in the U.S. have no limitations. They are allowed to spend any crypto funds they hold on the card.

Making Crypto More Feasible for Payments

After any customer in the U.S. signs up for the card, they get a virtual card immediately while the physical card is delivered two weeks after.

However, the card comes with transaction limitations when using the ATM, plus some foreign transaction fees are also attached.

But convenience may be the main benefit for users is eliminating the need for users to liquidate their cryptocurrency back into fiat when making purchases.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page