Investing In Cryptocurrency During A Recession

Last updated on July 25th, 2023 at 07:53 pm

A recession is a period of economic decline which typically follows periods of rapid growth and high inflation. During this time, people often feel uncertain about the future, leading to reduced spending and investment activity.

However, investing in any asset class during a recession can be a great strategy to build financial security and wealth.

Investing in cryptocurrency during a recession can be an effective way of utilizing an economic downturn and building generational wealth. While still affected by the traditional market factors, cryptocurrency often quickly recovers and creates more return on investment (ROI) than traditional investment vehicles.

Investing in cryptocurrency during a recession can provide an opportunity to capitalize on market volatility, as values of digital assets can experience sharp rises and falls.

Our current economic turmoil, which history will likely consider a recessionary period, is the first time cryptocurrencies like Bitcoin will be truly tested as an inflation hedge.

As such, investing in cryptocurrency during a recession is a smart strategy to help build and protect your wealth.

Let’s dive in and discuss what a recession is, look at some traditional recession investments, as well as why cryptocurrency may provide a better alternative to the traditional options.

Before investing in cryptocurrency, remember, this is NOT financial advice, I am NOT a financial advisor. You need to do your own research (DYOR) before investing and don’t invest money you can’t afford to lose. The results that I have experienced does NOT guarantee you will have the same outcome.

What Is A Recession

These days it seems like the definition of exactly what a recession is changes on an almost daily basis. This is especially true depending on who you ask.

So, I’ve decided not to ask any government agency… because honestly, since they are the ones helping to cause a recession along with the Federal Reserve, why let them control the narrative.

OK… before I get too high up on my soapbox, let’s give you an overall definition of a recession and back it up with some scholarly research.

A recession is a period of general economic decline in which GDP (Gross Domestic Product) falls, unemployment rises and the overall market experiences downward pressure.

It should be noted that the government continually changes what it includes in its analysis of GDP as well as how they calculate it, thus manipulating the numbers to fit the current situation.

A recession can be caused by a variety of factors including government policies, over-investment in certain sectors or changes in consumer demand.

During recessions, people often become fearful and stop spending, leading to a contraction in economic activity. This also happens and is compounded because The Fed raises interest rates.

Because we live in a debit based society, the only way new money comes into existence is when banks or The Fed create it by generating loans.

So, by raising interest rates, less loans are created and this causes a contraction of the money supply. This means businesses are unable to get credit and the money they need to continue to expand or complete other normal business activities.

When this happens, businesses start to lay people off. Because there are less jobs, this further decreases the amount of money in the economy as well as how and when it is being spent. This is often referred to as the velocity of money.

As the economy responds to these conditions, investors often look for safer assets that can provide stability and returns during the downturn.

Factors to Consider When Recession Investing

When investing during a recession, it is important to take extra precautions and consider several factors that can help maximize the potential of investments and mitigate the potential downside.

While recessions provide unique opportunities for investors, they also present additional risks that must be carefully monitored and managed.

Investors should consider inflation and deflation, liquidity, risk tolerance, diversification, market timing and other factors before deciding which recession investments are best for them.

By understanding the unique challenges of investing during a recession, investors can make informed decisions and potentially reap long-term rewards.

Let’s break down some of these items an investor must consider.

Inflation

Inflation is an economic concept that measures the average price of goods and services in a given country or region.

It occurs when there is too much money in the economy relative to available goods and services, causing prices to rise. This is also known as the law of supply and demand.

During recessions, inflationary pressures can have an impact on investors who must consider whether their investments will be able to withstand or benefit from any changes in the rate of inflation.

Historically investors have taken a few different approaches to investing during a recessionary environment.

Traditional inflationary investments typically involve purchasing fixed income instruments such as bonds and certificates of deposit (CDs).

Although these investments can be impacted by the overall rate of inflation, they generally provide a steady stream of income over time. As inflation rises, the value of these investments may decrease because the rate at which they generate returns is lower than the rate of inflation.

We have already seen this happen in our economy over recent years.

Other investment vehicles investors often choose as an inflation hedge includes index funds, stocks and real estate. These investments can provide higher returns than traditional fixed income instruments, however they also involve greater risk.

At the end of the day any inflationary investments should be carefully considered in order to ensure that the potential return outweighs the risks.

Deflation

Deflation is the opposite of inflation and occurs when there is too little money in the economy relative to available goods and services, causing prices to fall.

This can have a devastating effect on investments due to decreased consumer spending, which often leads to sharp falls in stock prices and reduced business activity.

This type of economic activity is certainly something The Fed doesn’t want to happen. This has been a long standing concern of regulators and has been talked about extensively since 2002.

Then, former Fed Governor, Ben Bernanke talked about what the Fed could do to avert deflation.

Besides the effects deflation can have on goods and services in every sector of the economy, it can have significant effects on investments.

As such, investors must be vigilant about monitoring deflationary pressures during a recession.

Liquidity

The ease with which an asset can be converted into cash without impacting the underlying value of the asset is referred to as liquidity.

During recessions, liquidity may become a major factor for investors because it can be difficult to convert investments into cash quickly or being able to do so at the desired price.

In the article I’ve linked to here, I talk about considering liquidity when you are deciding on what cryptos you want to invest in. As you read through this article you will start to understand the importance of ensuring your investments are liquid is a double edge sword.

While investors should always consider how liquid their investments are, this is especially important during a recession. Having a plan in place to cover any liquidity issues that may arise is a good idea for anyone who is making investments during a recession.

Inflation, deflation and liquidity all play a role in the next factor which is understanding how much investment risk you can tolerate.

Risk Tolerance

Risk tolerance is an important factor to consider anytime you decide to invest, but it’s especially relevant when investing during a recession.

Investing always carries some degree of risk, and investors always need to remain aware of them. However, it’s necessary for an investor to understand their own personal risk tolerance and make sure that their investments are in line with this level of risk.

I talk more about risk tolerance and how it plays an important role in your overall investing strategy in this article.

Need to know more about risk tolerance?

This 2001 study breaks down risk tolerance as it relates to economics and provides some insight into investor psychology.

Ultimately, by understanding both the potential rewards and risks associated with an investment, coupled with an understanding of your personal tolerance for risky investments, an investor can make the most informed decisions.

Learning to reduce risk vectors is key during a recession. This next strategy can help.

Diversification

Diversification is an important strategy for investors to consider. When you diversify your investments you’re spreading your investments across different asset classes, sectors and in some cases even geographical areas in order to reduce overall risk.

By investing in products that are less likely to be affected by a recession, you can spread out the potential losses and increase your chances of returning a profit.

Furthermore, if you diversify your investments across multiple asset classes you can potentially reduce risk even further and minimize their losses should the entire market take a plunge due to the recession.

This diversification is best done between asset classes, but should also be done within an asset class.

So for example, diversifying between stocks, gold and cryptocurrency is probably wise.

But, investing in certain types of stock sectors such as healthcare and energy you spread the risk out further as each of these sectors remain necessary during a recession.

The same is true with cryptocurrency. Investments can be spread out over layer 1s, NFTs and AI related projects as an example.

The bottom line is having an effective diversification strategy is essential for any investor looking to make money during a recession.

However, even by maximizing all of these strategies, there is still another element that is needed. As many investors say, it all comes down to timing.

Market Timing

Market timing is the process of buying and selling securities based on predictions about future market movements. While this strategy is more art than science, investors can still practice some form of market timing during a recession in order to minimize losses or increase profits.

An example of this is when investors look for opportunities to buy low when prices are down and sell high when prices are rising.

While no one can exactly time the top or bottom of a market, it is possible to understand the probabilities of market bottoms and tops. This is usually done by using technical analysis tools to help read market movements.

Another strategy that involves market timing is when investors put money in various asset classes during different stages of a recession. This is because each asset class may react differently during different stages.

Market timing requires an investor to understand the markets and and complete in-depth analysis of each asset class before making any decisions about when to buy or sell.

Other Investment Considerations

While everything we’ve discussed above are very important factors, there are a few other things to consider, especially during a recession.

Types of Assets to Invest In

During a recession, it is important to carefully choose the types of assets you are investing in.

Previously, investing in low-risk investments such as government bonds, treasury bills and high-grade corporate bonds have been a good option. However, we’ve seen the erosion of bonds over the last few years alone.

Other investment vehicles utilized during previous recessions include gold or other precious metals. As these types of investments have been around for centuries as money throughout history, these may provide some protection during times of economic turbulence.

Are you interested in investing in gold?

Now you can dollar cost average into gold using the same company I do, Acre Gold.

Learn More About Your Options With Acre Gold Here

I would argue that investing in cryptocurrency will show itself as a superior option to maintain and increase your overall wealth.

As with all other potential investments, research, understanding of a crypto as well as grasping how a crypto fits into the overall macroeconomic strategy is critical.

Monitor Economic Factors

Economic factors such as unemployment rates, consumer confidence, GDP growth and inflation are critical macroeconomic indicators that must be monitored during a recession.

In previous recessions, economists have also concluded that it can be helpful to keep an eye on the stock markets in order to spot any potential signs of volatility or a shift in market sentiment.

Personally, I would argue that the stock market is far to manipulated by The Fed to be an accurate indicator. As a result of this manipulation, there are a litany of zombie companies on the stock market which are just waiting to collapse.

However, by monitoring these economic indicators and using critical thinking skills, an investor can make informed decisions and also consider the tax ramifications of their investments.

Potential Tax Advantages

Believe it or not, sometimes it’s not all about the money!

Some might argue that finding tax advantages or safe havens in your investment choices is indeed all about the money.

Perhaps they’re right… but by employing this strategy, it does not necessarily provide any other monetary incentive.

Recessions can provide investors potential tax advantages. For example, generally speaking, capital gains taxes are lower in recessions due to lower stock prices and decreased investment portfolio values.

This can result in significant tax savings for investors who choose to invest during a recession.

Furthermore, governments may offer tax incentives for investments made during a period of economic uncertainty like a recession.

For example, some countries, states and even local governments may offer tax breaks or other forms of support to encourage businesses to invest in their own economy.

Planning for Downturns

Planning for a market downturn during a recession might seem redundant… I mean after all, the market is already down significantly.

However, planning for further economic downturns amounts to having a backup plan just in case any of your investments decide to take another plunge.

Investing in both traditional and alternative markets can help prepare investors for any potential market downswings. But more than that, having additional capital liquid and ready to deploy in those markets can be a solid back up plan when market movements happen.

These alternative markets can include gold, silver or other precious metals as well as real estate and cryptocurrency. All of these can potentially provide a hedge against inflation and provide a safe haven for investors.

Crypto Recession Investing Factors

As you may have already figured out, I believe that cryptocurrency is one of the best options for hedging against the current monetary system as well as providing us the opportunity to increase our wealth.

However, like any other investments, there are still some things you need to consider.

Benefits of Investing in Crypto

As I mentioned earlier, this record inflation and recession will be the first time in history we will see how Bitcoin and cryptocurrency react against these turbulent economic forces.

Until recently, cryptocurrency has moved in correlation with stocks and other traditional assets.

However, I would argue that this connection has begun to decouple. As such, we are beginning to see a lack of correlation to traditional stock markets.

Moreover, even when crypto assets do follow the overall economic trends, they’re stabilization and recovery has been getting better than the unmanipulated markets.

As this decoupling continues to become more pronounced, the viability of cryptocurrency as an inflation and chaos hedge will not only increase but solidify itself economically.

Analyzing Crypto Market & Trends

It’s good advice to DYOR and analyze a market before investing. This is especially true for the crypto market.

Under normal market conditions, crypto assets are volatile. Although since their inception to now, these price fluctuations have mostly followed the Bitcoin halving cycle.

However, making investments in various cryptocurrencies during a recession poses an entirely new set of variables. So it is not just important to analyze the current markets and trends in order to make a smart investment decision, it is critical.

During a recession, before investing in crypto it’s advisable to analyze both the global macroeconomic environment as well as the microeconomic landscape within each crypto investment. This one step can give you an edge when it comes to determining which categories of cryptocurrencies are likely to perform well during a recession.

Furthermore, it’s a good practice to keep attuned to cryptocurrency news from sources other than mainstream media outlets. News sources from within the financial and cryptocurrency related spaces will provide the most accurate insight on what’s happening.

If you have the training, using technical analysis tools can help when planning your recession related investing. These tools can help you gauge the probabilities of market movements and provide an unbiased insight into a particular crypto.

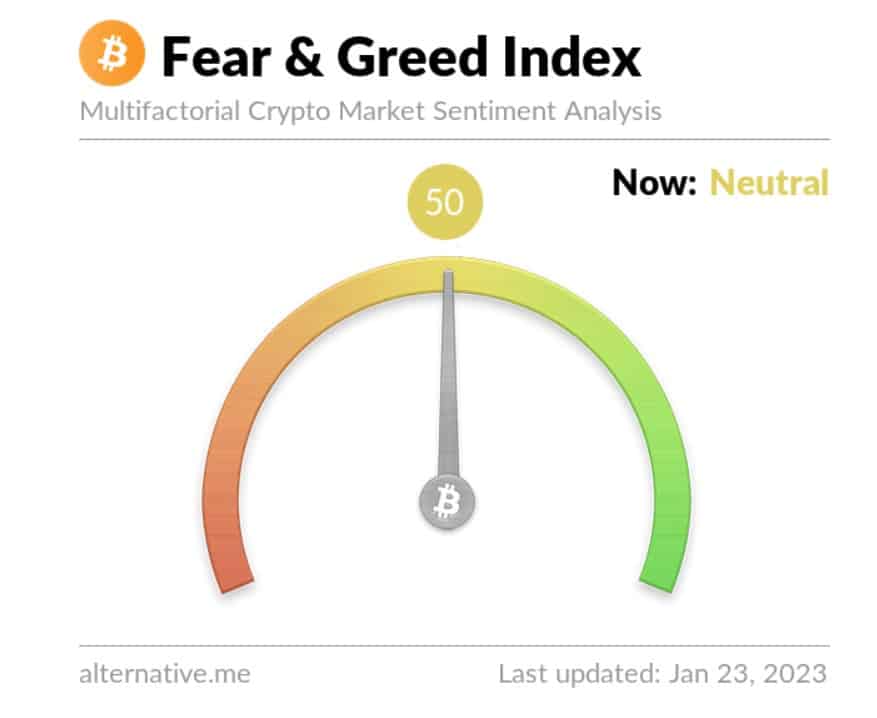

Finally, you can also analyze market sentiment. This is probably the least reliable metric in your analyzing arsenal, but worth consulting. Tools like the crypto fear & greed index can help you gauge market sentiment.

Tactics For Mitigating Risk

It probably seems logical to mitigate risks anytime you’re investing.

However, given the inherently volatile nature of cryptocurrency, making every attempt to reduce your risks can not be overstated.

One risk mitigation strategy is dollar-cost averaging. This can help because you are spreading out your investments over time rather than making big lump sum purchases.

Another risk mitigation strategy is diversifying your investments. This strategy should be employed both within the cryptocurrency space and beyond.

By investing in different categories of cryptocurrencies or different assets outside of crypto, you can reduce the risk associated with any one particular investment.

Recession Investing Recap

Some of the richest people in the world have created their fortunes by investing during a recession.

During a recession fewer people are investing in traditional markets. So the potential to find hidden gems there certainly exists.

However, investing in cryptocurrency during this period of time may provide access to potential investments that are off the radar for many investors.

As such, it is possible to find attractive crypto investment opportunities within the space that could potentially provide significant returns over time. Given that the crypto space already offers investors a vast array of choices, it’s even more vital that you DYOR.

By understanding the unique risks and rewards of investing during a recession, investors can make informed decisions that help them maximize returns while minimizing any potential losses.

As with any type of investing, research and advice from qualified financial advisors are essential to success. With the right knowledge and strategy, investors can find success even during a recession.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page