Cryptocurrency: Is It Real Money?

Last updated on June 8th, 2023 at 03:27 pm

For anyone starting out in crypto, there are often more questions than answers. As a matter of fact, the more you delve into the topic, the more questions you will inevitably have. When I started out in the space, one of the most basic questions that I had was about Bitcoin and cryptocurrency being real money.

Cryptocurrency is is not considered real money in most countries across the globe. Cryptocurrency was created to be a digital form of money designed to be used as a form of payment between two parties, without the need for a trusted third party, like a bank. In the United States, cryptocurrency is considered property. This makes it subject to capital gains taxation.

However, while most people say that paper money is the only thing considered real money, after dealing with your bank, PayPal or some other money relate apps on your phone, you know this is not really the case. Deciding exactly what real money is depends upon many factors, including the country you live in, your ability to access the banking system in that country as well as the regulations of your country.

With this in mind, let’s dive a bit further into exactly what real money is in the United States and how cryptocurrency fits in.

Table of Contents:

What Is Real Money?

The term real money, at least the way we laymen use the term, is meant to refer to the money we can use to buy things and to determine the value of things.

This is actually more inline with the definition of money.

The actual definition of real money has a totally different meaning.

The term real money, as it is used in the financial space, refers to larger entities that trade considerable amounts of capital. These entities include groups like hedge funds and asset managers. These groups are often considered to be those that look at the financial markets in the long term, rather than just the immediate market fluctuations.

But there is much more to consider when talking about real money. Let’s take a quick look at some of these factors that most of us presume are part of the equation when we talk about real money.

Sound Money

When you and I talk about money, without realizing it, we are actually again mixing our definitions.

We will discuss the current understanding of the word money in a moment, but right now we need to talk about sound money. Frankly, most people assume that when you talk about anything money related, that money being ‘sound‘ is implied.

Honestly, nothing could be further from the truth!

But, before we get to that, we need a quick history lesson about how our current monetary system in the United States was contrived.

Though The Fed was actually created in 1913, for this part of the history lesson we only need to travel back to 1944. World War 2 had just come to an end and the world needed to rebuild. Unfortunately, because of the war, many countries were not only physically in ruins, but financially ruined as well.

To help establish a standard for the world, leaders from 74 countries met in Bretton Woods New Hampshire. This meeting, now referred to as the Bretton Woods agreement, established that fiat currency would be backed by gold.

They fixed the exchange rate of gold at $35/ounce and established that the U.S. dollar would be the world reserve currency using that standard.

Because gold is one of the oldest and most widely accepted mediums of exchange, it is easy to see why they chose gold to set the exchange rate between currencies.

This became known as the gold standard.

In our modern era, this standard remained in place until 1971. That is when President Richard Nixon took the United States off of the gold standard and started the world down it’s current path, using fiat currency as an everyday form of exchange.

I am old enough to remember President Nixon’s address to the country on TV, but was not old enough, at the time, to appreciate the significance of it.

Now that we’ve looked at history, it is easy to understand sound money.

Sound money is a currency that is backed by a tangible asset.

From 1944 to 1971, that tangible asset was gold. Thus the world had a sound money system.

Fiat Money

Today, when you and I talk about money, without realizing it, we are actually talking about fiat money.

Fiat money is currency backed solely by a government. Fiat currency has no intrinsic value. It derives its value from the participants in the economy in which it is used. They trust the government and use the government issued currency.

When President Nixon removed the United States, and thus the world from the gold standard, he not only placed the U.S. on the fiat monetary system, but the entire world.

Fiat currency is not actually issued by a government, it is issued by the central bank of that country. In the case of the United States, the Federal Reserve (The Fed) is the issuing authority.

Make no mistake, even though the word federal is in their name, the Federal Reserve is not part of the government, nor controlled by the government.

Even though a central bank, such as The Fed, are not actually government entities, the currency they issue is backed by the government.

So, given that a fiat currency is backed primarily by the trust of the government that endorses it, the value of that currency in tied to the reputation and confidence in that government.

Our Definition of Money

Going forward, when I mention money, I will be speaking about money in the layman’s use of the term, unless I specify otherwise.

I realize, that unless you are a business or accounting major, understanding these definitions, that frankly, seem to ‘split hairs’ and honestly should be an intrinsic part of the definition we are discussing, can ultimately be a bit confusing.

So again, I will refer to money going forward, just as most people consider it… something they can use to buy things, save in their bank account and use to determine how much something is worth.

What Gives Money It’s Value?

There are many factors that go into determining the value of money. However, since this is not meant to be a course in economics, I will endeavor to keep everything as close to layman’s terms as possible.

The most commonly used method of determining the value of money is considering it as a medium of exchange. So, the aggregate supply of a currency as opposed to the demand for that currency. This supply and demand is influenced by factors such as inflation, the velocity of money and the available supply of money.

So, to increase our overall understanding of money and it’s value, let’s take a look at these money valuation factors.

Inflation

It seems like no matter where you turn today, all you hear is about inflation. This is for good reason. As of the writing of this article, the United States is experiencing the highest inflation in over 40 years.

Inflation, by definition, is a broad rise in the price of goods and services.

So, for every single one of us, inflation is increasing the price of everything from food, to home prices, to gas for our cars.

However, the reason for this is not because companies are arbitrarily choosing to demand more for their goods and services. It is because the overall supply of money available has increased.

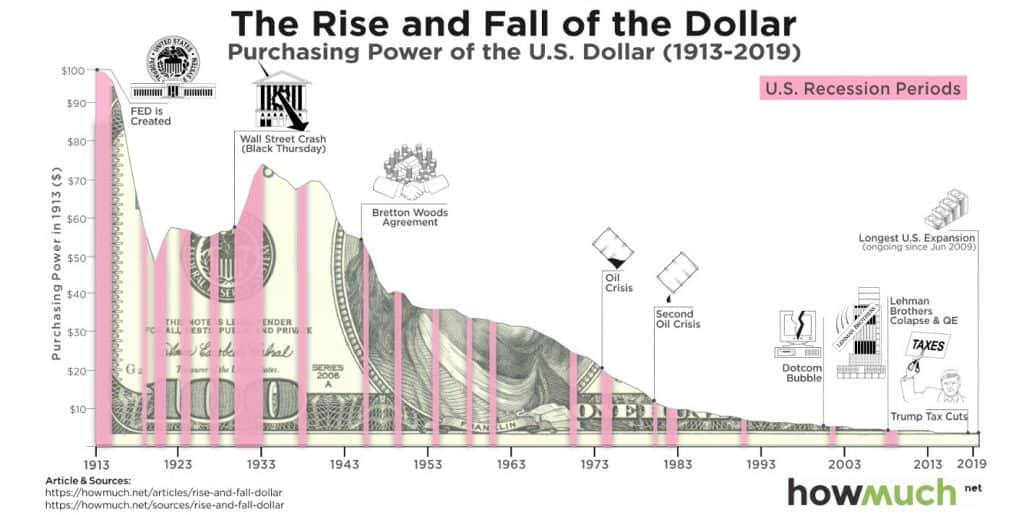

This increase has devaluated the U.S. dollar in this case and decreased it’s overall purchasing power.

Velocity of Money

The velocity of money is not a term that is mentioned often when talking about money. However, it is an important monetary factor, especially when combined with the entire money supply and the rate of inflation.

The velocity of money is a measurement tool to determine the number of times a unit of currency is exchanged domestically for goods and services during a specific period of time. The velocity rate of a given currency can be calculated by dividing the Gross Domestic Product (GDP) by the money supply.

Money Supply

The definition of the money supply is very much like it sounds. This is the total amount of currency in circulation at a given time.

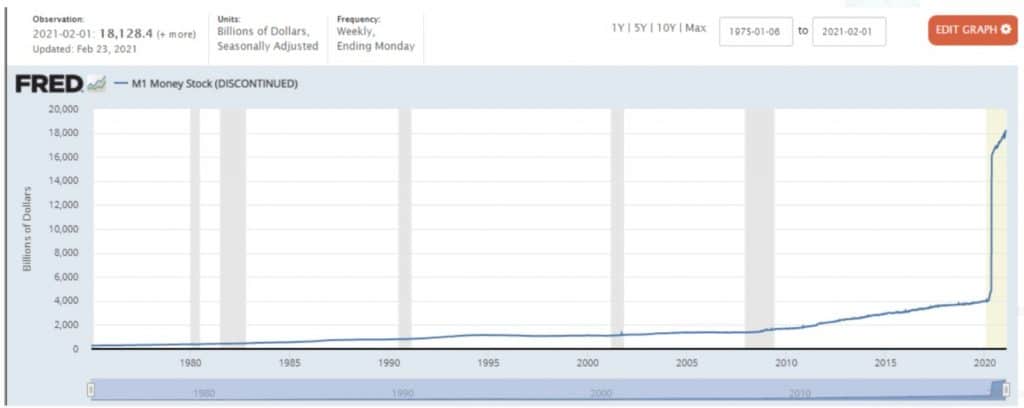

For over a decade The Fed has been using the money supply to help control and otherwise regulate inflation.

They have done this by increasing the circulating supply of money and injecting it into the economy, otherwise know as quantitative easing.

To help you and I understand how this affects the value of the U.S. dollar, you need to understand the idea of scarcity. Generally speaking, the more scarce an item is, the more valuable it is.

As an example, precious metals, like gold are quite scarce. This is part of the reason for gold being a relatively reliable store of value, and the world using it, as we mentioned earlier, to create the gold standard.

I know, I just threw another new term at you, store of value. But, I’m going to guess that you understand it without me even writing the definition.

But, how would that be helpful if I didn’t?

Basically, for an asset to be considered a store of value it must maintain it’s value without depreciating.

Since 2020, The Fed has increased the circulating money supply by over 42%. This means that 42% of all the money in circulation has been put there in less than 3 years.

Although recent Fed actions show a slowing of money printing, this is still a significant amount of money injected into the U.S. economy. This process of slowing down the amount of money entering the economy is know as quantitative tightening.

So, by understanding nothing more than the idea of scarcity, you can understand why the value of the U.S. dollar continues to decrease at an alarming rate.

Let’s face it, for a country’s economy to be stable, the country’s currency must be considered a store of value. This has been a decreasing characteristic of the U.S. dollar, and now you can understand why.

After starting to understand how all of this affects our economy and our currency, it becomes easy to understand why people have started to search for alternative forms of currency.

Where Is Cryptocurrency Considered Real Money?

There has been a slow, yet steady increase in the number of places that consider cryptocurrency, Bitcoin in particular, legal tender.

The very first country to accept Bitcoin as legal tender was El Salvador. The president of El Salvador, Nayib Bukele, made this historic announcement at the Bitcoin 2021 conference.

Since then other countries have at least started to explore the possibility of accepting Bitcoin as legal tender. These countries include Mexico, Uruguay and Tanzania to name a few.

This acceptance of Bitcoin and cryptocurrency has found its way to various cities and states throughout the U.S. Some of the most notable include Arizona, Florida, Missouri and Colorado.

Will Cryptocurrency Ever Become Real Money?

So, the question that presents itself is, does cryptocurrency have a future as real money?

Honestly, there is probably no one who can look into their crystal ball and answer that question. But, we might be able to make an educated guess given the current track of money in the world.

The lifespan of fiat currency, as the world reserve currency is approximately 100 years. The U.S. dollar is currently at that time frame and we can see the cracks starting to form and expand. This will eventually lead to some sort of collapse.

Moreover, the world has already started to digitize money.

Most people don’t carry dollar bills in the wallet these days, they use their credit or debit card to pay for things. This is further highlighted by the money payment apps on your phone like PayPal and Cash App.

Not to mention, many nations across the globe are looking into creating their own Central Bank Digital Currency (CBDC).

While CBDCs are meant to act like cryptocurrencies, they are not the same. The biggest difference is that CBDCs are created by a centralized authority.

This means that is is a permissioned system, so a person like you or I needs permission to operate within it. Not to mention that they can program and control the money supply at the press of a button. The CBDC can be made to do, or not do, anything.

Cryptocurrency in contrast are generally decentralized. This means that the system is permissionless, so anyone can participate in it. Furthermore, this means that no one person controls a crypto and all transactions are verifiable on the blockchain..

Given this move toward digital currency, it is possible to surmise that future currency will likely be in digital form, however, will it be a cryptocurrency like Bitcoin or a CBDC remains to be seen.

Questions About The Future of Money

What is the future of money?

The future of money is a movement from cash to cashless. This means that digital currencies will be the norm. Read More About Digital Currency Replacing Money Here.

What is cryptocurrency used for?

Cryptocurrency usage is growing across the world. Currently, crypto can be used as a medium of payment or exchange for just about anything. Read More About The Uses For Crypto Here.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page