Cashing Out With Crypto: Turning Crypto To Cash

Last updated on June 8th, 2023 at 03:29 pm

For those new to the cryptocurrency space, converting your cryptocurrency back to cash, or the fiat currency for your country, can potentially be a daunting task.

Cryptocurrency holders have a few methods available to convert their digital assets back to fiat currency. These methods include using a centralized cryptocurrency exchange, peer-to-peer (P2P) exchanges, hardware cryptocurrency wallets, money transfer apps, crypto debits cards and Bitcoin ATMs.

With so many different ways to cash out and fees associated with each method, it’s important to make sure you understand all of the implications of exchanging from crypto to fiat before initiating any transactions.

Fortunately, there are secure, reliable options for cashing out your digital assets.

By researching all of the available options and understanding the associated fees and potential tax implications, you can make sure that your crypto assets are converted back into cash as securely and efficiently as possible.

Let’s get into how to get it done…

Converting Crypto To Fiat

Let’s face it, people invest in cryptocurrency for an unending number of reasons. Some of these reasons include investing in crypto as a way to diversify their portfolio, hedge against inflation, and potentially generate returns.

Ultimately, no matter the reason, investors, during the course of their crypto journey, may decide to turn their digital assets back into their local fiat currency.

Regardless of the reason, converting crypto back into cash is a vital part of the cryptocurrency journey and all angles should be carefully considered before initiating any transactions.

Let’s look at some of the ways you can convert your cryptocurrency back to cash.

Centralized Crypto Exchange

The primary way I tell those interested in cryptocurrency to enter into the space is by using a centralized cryptocurrency exchange.

My recommendations for U.S. residents are Coinbase, Gemini and Kraken.

So, it would follow that if this is how you initially invested into cryptocurrency, this would likely be your primary way to convert your crypto back to cash.

These exchanges are online platforms that facilitate the buying and selling of various cryptocurrency assets. So, if you have a crypto like Bitcoin, Ethereum or some other altcoin, these exchanges may be the easiest place to make the conversion happen.

For those crypto investors with more significant holdings, these exchanges also offer something called an Over-The-Counter (OTC) desk. These OTC desks are meant to service the clients who are investing large sums of money unlike the average retail investor like you and I.

OTC desks can get these “whale” clients a better buy and sell price as well as complete the entire process and if necessary. They often also offer their clients custody services.

For us simple retail investors, the process of exchanging crypto for fiat on a centralized exchange is very straightforward.

Once you have a verified account, transfers between the exchange and your bank are simple and often complete within 3 business days.

While using a centralized exchange for cashing out your crypto is secure and relatively quick, these exchanges charge a fee. These fees can be high, so it’s important to check the terms and conditions before initiating any transactions.

If you want more information about cryptocurrency exchanges, you can read the latest here.

But if a centralized cryptocurrency exchange is not your preferred choice for converting your crypto, perhaps something more personal will fit the bill.

Peer-to-Peer (P2P) Exchange

Another great option for converting your crypto back to fiat is by using a Peer-to-Peer (P2P) exchange.

P2P exchanges act as a secure platform allowing individuals to buy and sell cryptocurrencies directly between each other. This allows traders to make conversions at competitive rates with minimal fees.

The main advantage of a P2P exchange is its ability to facilitate direct transactions between buyers and sellers.

Additionally, since the transactions are conducted directly between two individuals, traders have more control over their funds and can easily switch from one asset to another without any transfer fees.

If a P2P platform is what you’re looking for, I suggest Paxful. This platform has been around for several years and I have used it with success.

The drawback to this type of platform is that there is generally a mark-up or premium charged for the crypto you are looking to purchase or trade.

Overall though, a P2P exchange is a great way for traders who are looking to convert cryptocurrency into cash without relying on a centralized exchange to get it done.

If you practice self custody, then once you’ve purchased crypto on an exchange, you transfer it, as soon as possible to a self custody wallet. Some of these wallets give you the ability to convert your crypto.

Hardware Crypto Wallets

One of the basic tenets of cryptocurrency is being your own bank. You accomplish this by self custodying your cryptocurrency.

Using a hardware wallet to self custody your crypto is the safest method for securing your digital asset for the long term.

But hardware wallets like Ledger have built-in options for you to convert your crypto to cash. In the case of Ledger, you can make this happen by using Ledger Live.

If you want to see more about Ledger Live you can watch my video here.

This makes hardware wallets, like Ledger perhaps the safest method to store your crypto and exchange your assets for fiat currency.

However, keep in mind that you may need to pay fees when selling your crypto and transferring your cash back into a bank account.

For more information about cryptocurrency wallets, check things out here.

But if you are one of the small percentage of cryptocurrency investors who choose to purchase crypto via a money app, then you have another conversion option.

Money Transfer Apps

Money transfer apps such as PayPal, Cash App and Venmo are becoming increasingly popular among cryptocurrency investors who want a convenient way to not only purchase crypto, but convert their digital assets into traditional currencies.

These money apps offer an easy-to-use platform for users. Generally available right from your phone, you can exchange crypto for fiat currency without having to go through a complicated signup process or worrying about any third party custody, like a cryptocurrency exchange.

Additionally, many money apps are very cost-effective, often offering free or reduced-fee transactions for those who use their own currency.

The ease and convenience of use with these money apps is not always the case… to be completely honest, I use PayPal here on CryptoCoinMindSet… primarily because it is a convenient payment rail that many consumers are familiar with.

But PayPal has not always been a friend of the cryptocurrency space… and frankly, PayPal is not a friend of anyone that does not agree with their agenda.

Like most money apps, PayPal are opportunists. It is for this reason that I DO NOT recommend this option for buying or converting your crypto.

However, in recent years crypto finance has evolved offering crypto investors and users another option to convert their crypto holdings.

Crypto Debit Cards

For most people today, a debit card is what we use to go shopping, pay for our purchases online and frankly, just about everything else we do.

Because of this, crypto debit cards are becoming increasingly popular among cryptocurrency investors and users as a means to convert their digital currency holdings into traditional fiat currency.

Debit cards provide an easy, secure way to access your funds anytime, anywhere.

With these types of cards you can easily transfer your crypto balance onto the card, use it in stores, and withdraw cash from ATMs.

Crypto debit cards are accepted by the same merchants who accept traditional credit and debit cards, so you don’t have to worry about getting stuck being unable to pay.

If this is an option you’re looking for, I recommend, and use, the Blockcard.

Originally, this project was named Ternio. It was rebranded to UNBANKED.

They provide a full service banking & cryptocurrency experience to their users, including a crypto debit card.

For more information about crypto debit cards, check this link.

But for some in the crypto space, they feel more comfortable with a more traditional banking option.

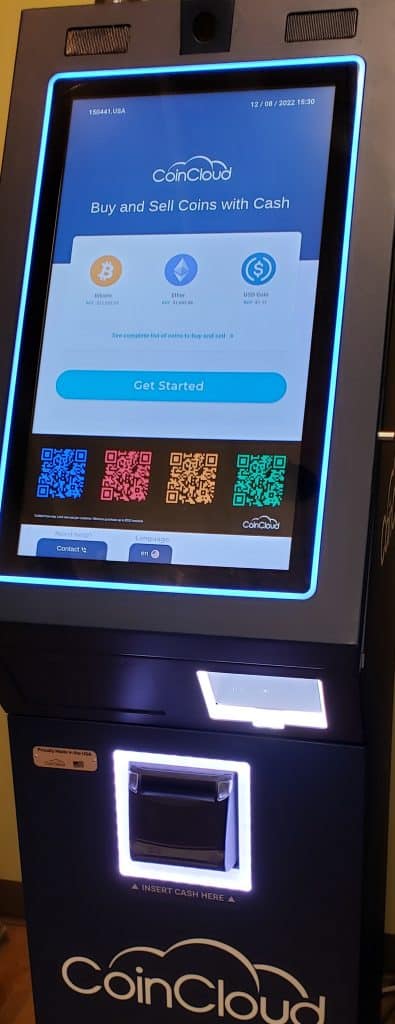

Bitcoin ATMs

Bitcoin ATMs provide a simple, secure way to convert your crypto into cash.

They work just like regular ATMs, but instead of withdrawing money from a bank account, you’re sending and receiving Bitcoin.

Using a Bitcoin ATM is convenient for many users and traders since it can be done quickly and anonymously right near your home.

You can locate Bitcoin ATMs near you by visiting websites like CoinATMRadar or Google Maps.

Furthermore, these machines are also becoming increasingly accessible worldwide with more companies setting up their own ATMs in different countries.

Bitcoin ATMs are a great way to quickly turn your crypto into cash.

More people now have access to powerful financial tools that allow them to store and transfer money and crypto with ease.

While these crypto conversion options are relatively easy to use, there are other considerations to keep in mind when moving between crypto and cash.

Crypto To Fiat Conversion Advantages & Disadvantages

| Conversion Platform | Primary Advantage | Primary Disadvantage |

|---|---|---|

| Centralized Cryptocurrency Exchange | Easier & Faster Conversions | Need KYC Account & High Transaction Fees |

| Peer-to-Peer (P2P) Exchanges | Lower Transaction Fees | Slower To Transaction Times & Requires Negotiation |

| Hardware Wallets | Overall Security | High Conversion & Transaction Fees |

| Money Transfer Apps | Convenience & Ease of Use | High Conversion & Transaction Fees |

| Crypto Debit Cards | Easy Access & No Bank Account Required | High Conversion Fees |

| Bitcoin ATMs | Worldwide Availability | High Fees & Withdrawal Limits |

Crypto To Fiat Conversions Considerations

When converting cryptocurrency to cash, there are other considerations to keep in mind. These include such things as taxes and trading fees.

Depending on your country’s tax laws, you may be liable for capital gains taxes if the amount of money you make exceeds a certain threshold.

Additionally, whether you’re using an exchange, wallet or ATM, there are most likely fees charged for transactions. Fees will obviously vary depending on the medium used, as well as the total amount of the conversion.

Let’s take a quick look at a few of these additional considerations before you make a decision about how you’re going to convert your crypto.

Taxes

If you’ve ever paid taxes before you know that the government always gets their fair share… and sometimes, much more!

No matter what country you reside in, converting cryptocurrencies to cash can affect your taxable income.

This is true in the U.S. In short, every time you sell, trade or use a crypto, you create a taxable event which must be reported to the Internal Revenue Service (IRS). Be sure to consult a tax professional for advice.

For more worldwide tax related information, check this link.

While the tax implications are certainly important, other fees can eat more of your money than taxes.

Trading & Conversion Fees

No matter if you are transacting in the crypto space or not, everyone wants a piece of the action. This piece of the action generally comes in the form of fees.

When converting cryptocurrency to cash, it’s important to take into account the fees associated with trading and conversion.

Most exchanges charge trading fees that range from 0.1-0.5%. Additionally, most exchanges have a minimum trade size they require in order to participate in trades.

Another fee to consider is the conversion fee.

Conversion fees are typically a percentage of the amount you’re converting from one currency to another and can vary depending on which exchange or payment processor you use.

No matter what, be sure to understand the fee structure of the platform you decide to use to make the transition from crypto to cash.

But for many of us, what we use to move our assets from one form or another depends in large part to the timetable.

Transaction Completion Speed

Speed is a key factor when it comes to converting cryptocurrency to cash. Oftentimes when making any financial transaction, time is of the essence and having your funds available quickly is critical.

Depending on the platform or service you use, the transaction can take anywhere from minutes to days.

When you’re ready to convert crypto to cash, be sure to research the platforms and services available to you, including the timetable for transaction completion.

Remember, it’s not just the time necessary to convert your crypto to fiat, but also the time necessary to move that fiat into your bank account.

Crypto Conversion Conclusion

For most people, the movement of finances is from fiat to crypto.

But for a variety of reasons, there may be a need to take those crypto investments and turn them back into cash. There are a few methods available to accomplish this.

These include using a centralized cryptocurrency exchange, using a peer-to-peer (P2P) exchange, using hardware wallets, using money transfer apps, using crypto debit cards and using Bitcoin ATMs.

Each of these options has distinct advantages and disadvantages.

These advantages range from ease of use and easy availability to no bank account requirement.

These disadvantages range from high fees and the need for bank accounts to withdrawal limits.

Do your own research (DYOR) to decide which of these conversion methods is best for your situation.

Frequently Asked Questions (FAQ)

Q: What are the best ways to convert cryptocurrency into cash?

A: The best ways to convert cryptocurrency into cash include using a centralized exchange, peer-to-peer exchanges, hardware wallets, money transfer apps, crypto debit cards and Bitcoin ATMs.

Q: How long does it take to transfer cryptocurrencies to cash?

A: The length of time it takes to transfer cryptocurrencies to cash depends on the method and platform or service you use. Generally, transfers can take anywhere from minutes to days.

Q: Are there fees associated with converting cryptocurrency into cash?

A: Yes, there are typically fees associated with converting cryptocurrency into cash. These could include trading fees (from 0.1-0.5%) and conversion fees (a percentage of the amount you’re converting from one currency to another).

Q: Do I need a cryptocurrency wallet to convert crypto to cash?

A: Some methods of converting crypto to cash may require a wallet, such as peer-to-peer exchanges, hardware wallets and Bitcoin ATMs. However, other methods such as using money transfer apps or crypto debit cards may not require a wallet.

Q: Do I need a bank account to convert cryptocurrency into cash?

A: Not necessarily. Some methods of converting crypto to cash may not require a bank account, such as peer-to-peer exchanges and Bitcoin ATMs. However, other methods such as using money transfer apps or crypto debit cards may require you to have a bank account in order to complete the transaction.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page