Regulation To Liberation: Centralized vs Decentralized Exchanges

Cryptocurrency exchanges are an integral part of the crypto landscape. They provide their users with the ability to buy and sell digital assets quickly, and on a global scale.

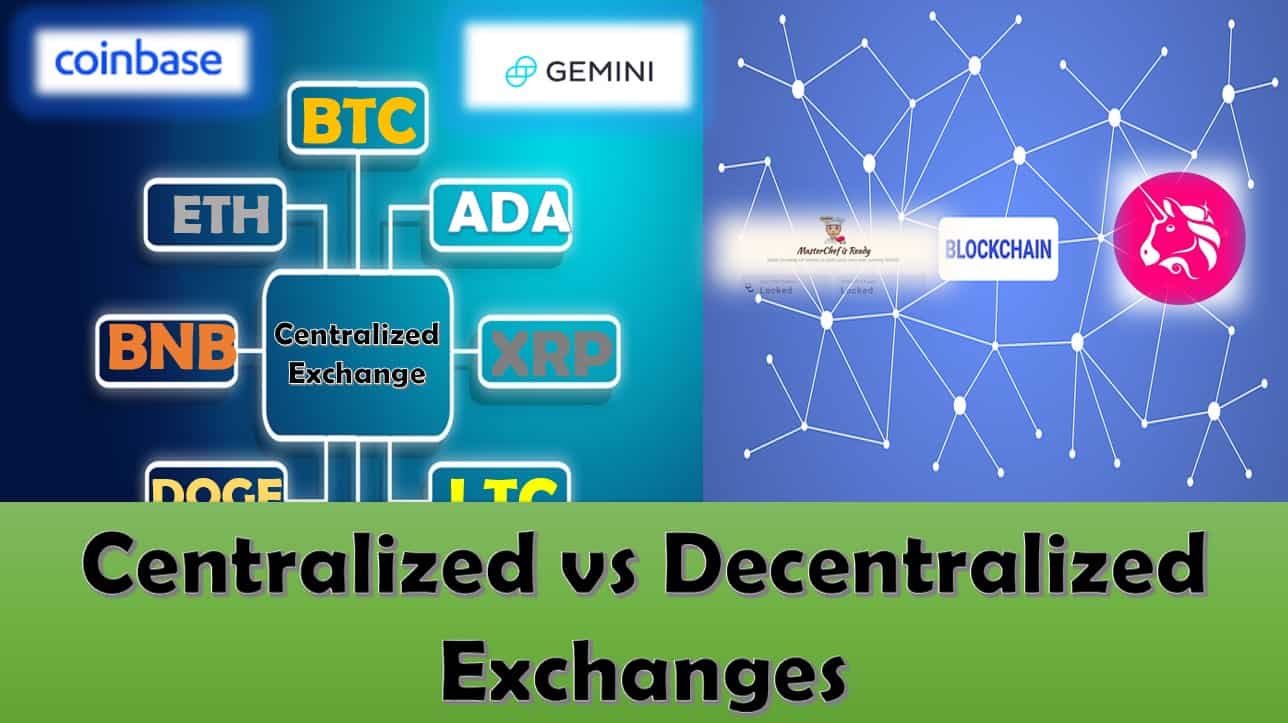

Traditionally there have been two main types of cryptocurrency exchanges; centralized and decentralized. Each offers different advantages.

A Centralized Cryptocurrency Exchange (CEX) is a digital platform where users can trade various cryptocurrencies through a centralized authority. It operates as an intermediary, facilitating transactions, holding user funds, and providing an order book. User identity verification is necessary. Control over funds and user information resides with the exchange.

A Decentralized Cryptocurrency Exchange (DEX) is a peer-to-peer marketplace where users can buy, sell, and trade cryptocurrencies without the need for a centralized intermediary. Operating on decentralized protocols and smart contracts, DEXs provide increased privacy, security, and transparency and users retain control of their funds. Transactions are verified through blockchain technology.

In this article we will compare and contrast centralized and decentralized exchanges. Including their structure, security as well as the advantages and disadvantages of each as it relates to the user experience.

Unraveling the Crypto Matrix: Centralized vs. Decentralized Exchanges

Core of Centralized Exchanges (CEX)

Ah, centralized exchanges, love them or hate them, they have been, and still are, an essential part of the crypto space.

Centralized Exchanges (CEX) are online trading platforms that have been developed to facilitate cryptocurrency trading. They emerged in the early days of cryptocurrency as an efficient way for users to trade digital assets from one wallet to another with ease and security.

From the early days of Mt. Gox, which stumbled upon the scene in 2010, to the popularization of giants like Binance and Coinbase, centralized exchanges have wielded their power as the gatekeepers of crypto commerce, facilitating liquidity, offering user-friendly interfaces, and providing a space for traders to dance with volatility.

Through their services, CEXs remain an integral part of the crypto landscape. As such, they are highly regulated, which provides users with peace of mind when trading on them… unless of course you are looking to remain anonymous.

If you’re curious to dive deeper into the captivating world of centralized exchanges, prepare to be enlightened… you can explore the centralized corridors of crypto commerce by venturing forth to discover more in my comprehensive outline about centralized exchanges.

The bottom-line is that CEXs have come a long way, evolving from rudimentary platforms to sophisticated marketplaces that cater to the whims and wishes of traders worldwide.

How CEXs Work

The process of working with a CEX begins with signing up for an account. Due to the centralized nature of these exchanges, users must provide personal information such as name, email address and sometimes ID documents to help the exchange comply with anti-money laundering (AML) and Know Your Customer (KYC) regulations.

Once the account is approved, users have the option to deposit fiat currency into their exchange account, which can be done through bank transfers, credit/debit cards, or digital payment platforms.

With funds in their account, users can browse the available trading pairs and choose the digital assets they wish to trade. Buying and selling of assets is done through the order books.

These order books provide the necessary liquidity for traders to complete transactions. The exchange does this by matching buy and sell orders from different users, and upon successful execution, updates the account balances accordingly. These order books are maintained solely by the exchange.

Depending on the regulations of the jurisdiction where the exchange is located, as well as that of the user, advanced trading options may be available. These options include margin trading, futures contracts and derivatives.

As I mentioned previously, due to AML & KYC regulations, collection and maintenance of user data is a major function of CEXs.

Let’s explore these roles in more detail…

Handling User Data

Because a CEX acts as a middleman for all of these financial transactions, they are responsible for collecting and controlling user data, as well as funds while facilitating transactions.

CEXs collect and store a significant amount of user data during the account creation and verification process.

This data includes personal information (Pii), such as names, email addresses, and in some cases, government-issued identification documents.

The exchange is responsible for securely storing this data and implementing robust security measures to protect user privacy.

At the end of the day, users must trust the exchange to handle their personal information responsibly.

Unfortunately that need for trust doesn’t end with user data.

Handling User Assets

Besides user data, CEXs also control the fiat and digital assets of their users.

This means that an exchange acts as a bank with a customers fiat currency and a custodial for the private keys of their users’ cryptocurrency.

When users deposit their funds on a centralized exchange, they essentially entrust the exchange with the custody of their assets. CEXs accomplish this by providing their users with custodial wallets.

Basically, these are wallets assigned to each use. They are available for the assets available for trade on the exchange, and they are fully controlled by the CEX.

This means that the responsibility lies with the exchange to safeguard the user funds through various security measures, including encryption, multi-factor authentication, and offline storage solutions.

However, it is important to note that entrusting funds to centralized exchanges comes with certain risks. Users rely on the exchange’s security practices and must trust that the exchange will keep their funds secure.

Incidents of hacking, internal breaches or an exchange closure can result in the loss of user funds, highlighting the importance of choosing reputable exchanges with strong security track records.

CEX Regulatory Compliance

Centralized exchanges operate within legal frameworks and are subject to regulatory obligations in different jurisdictions.

These obligations often include adhering to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

To meet these requirements, exchanges implement Know Your Customer (KYC) procedures, which involve verifying the identities of their users.

By recording and maintaining accurate user data, exchanges are better equipped to monitor and report any suspicious activities as mandated by the regulations.

If a user wants to use a CEX, it’s essential for users to choose reputable exchanges that prioritize security, user privacy, and compliance with regulations.

Pros & Cons of CEXs

CEX Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| User Friendly Interface | Centralized Control |

| Liquidity | Honeypot For Hackers |

| Fiat On & Off Ramp | High Transaction Fees |

| Customer Service | Lack of Asset Control |

| Requires KYC |

CEXs bring forth a range of advantages and disadvantages that users should consider.

On the positive side, these exchanges boast high liquidity and trading volume, thanks to their ability to attract a large number of traders. This translates into swift trade execution and competitive prices, as a bustling marketplace offers ample opportunities for buying and selling.

Additionally, CEXs often prioritize user-friendly interfaces, making them accessible even to newcomers in the crypto space. With advanced features and tools at their disposal, users can navigate the trading process more easily and benefit from a more streamlined experience.

However, it’s crucial to acknowledge the downsides of a CEX. The fact that they act as a central authority poses a potential single point of failure, leaving them vulnerable to hacking risks.

Past incidents have demonstrated the devastating consequences of security breaches, as well as the loss of funds when a CEX collapses and files for bankruptcy protection as was the case with FTX.

Furthermore, centralized exchanges typically require users to disclose personal details and complete KYC procedures, which compromises privacy. So, if a user wants anonymity, a CEX is not the path to follow.

Finally, another important point is that users also surrender control over their funds. So customers of a CEX must trust the exchange to manage and secure their assets.

It is essential for traders to carefully evaluate these pros and cons before deciding on the type of exchange that best aligns with their preferences and priorities.

And if these priorities include maintaining your privacy and control over your assets, it may be time to consider a decentralized option.

Core of Decentralized Exchanges (DEX)

Decentralized exchanges, commonly referred to as DEXs, revolutionize the way digital assets are traded by operating on decentralized networks and utilizing smart contracts.

Unlike their centralized counterparts, DEXs eliminate the need for intermediaries and central authorities, enabling users to trade directly with one another.

This eliminates the need for users to trust a third-party service with their private information and funds, giving them full control over their assets.

DEXs exhibit unique characteristics that set them apart from centralized exchanges.

Firstly, DEXs facilitate peer-to-peer trading, allowing users to interact and transact with each other directly, without relying on a central authority. This decentralized nature empowers users, giving them complete control over their assets.

Additionally, DEXs are typically built on blockchain technology which allows for faster execution times and trustless trading.

By utilizing trustless and transparent protocols and leveraging smart contracts to automate the process, trades are automatically completed once predetermined conditions are met. This eliminates the need to trust a central party and ensures transparency and verifiability of transactions.

Another distinguishing feature of decentralized exchanges is their emphasis on privacy. By minimizing the collection and storage of personal information, DEXs prioritize user privacy and confidentiality.

In contrast to centralized exchanges, where users must trust the exchange with their funds, decentralized exchanges enable users to maintain control and ownership of their assets throughout the trading process.

Security is enhanced through the use of blockchain technology, reducing the risks associated with hacking and providing users with a greater sense of security.

While decentralized exchanges may face challenges in terms of liquidity and user experience compared to their centralized counterparts, they offer a compelling alternative for users seeking autonomy, transparency, and enhanced security in their digital asset trading endeavors.

On the whole, DEXs offer a more secure trading experience due to their lack of central control. However, they may not be suitable for traders who require access to more advanced features or prefer to have better liquidity.

So with all of these differences, how does a DEX work?

How DEXs Work

Talk about the difference in night and day… that scratches the surface of the fundamentally different way a DEX operates in comparison to a CEX.

To start, DEXs provide users with enhanced control and security over their assets.

In a DEX, trading occurs directly between users without the need for intermediaries.

To participate in a DEX, users must have their own cryptocurrency wallets, where they store and control their digital assets. This wallet need to be able to integrate with the DEX’s interface. Generally a hot wallet like MetaMask is used.

Because of this, unlike CEXs, where users transfer funds to exchange-controlled wallets, in a DEX, users maintain control of their assets throughout the trading process.

DEXs leverage decentralized protocols and smart contracts to match buy and sell orders. When a user places a trade order, it is broadcasted to the network, and the decentralized protocol matches suitable counterparties based on predefined parameters.

Smart contracts then automate the trade execution, transferring the assets directly between the wallets of the involved parties.

This user-centric approach provides advantages such as increased privacy, as users are not required to provide personal information or undergo identity verification.

Additionally, the user retains control over their assets, reducing the risk of exchange hacks or compromised funds.

The transparency and immutability of blockchain technology ensure that transactions on a DEX can be audited and verified by anyone, fostering trust in the trading process.

Given all of this, DEXs revolutionize the traditional centralized exchange model, empowering users with greater autonomy and security over their cryptocurrency trading activities.

This can easily be seen when examining how a DEX generates trading liquidity.

DEX Liquidity

While both CEXs and DEXs both have the need to create liquidity for trading, they employ different mechanisms to achieve this goal.

As I mentioned previously, CEXs rely on order books and matching algorithms to facilitate trades between buyers and sellers.

So, liquidity is generated by the presence of multiple participants placing orders within the exchange.

On the other hand, DEXs leverage Automated Market Makers (AMMs) and Liquidity Pools (LPs) to enable peer-to-peer trading.

AMMs are algorithms integrated into DEXs that enable trading without relying on traditional order books. These algorithms use mathematical formulas, such as the constant product market maker (CPMM) model, to determine prices and execute trades.

Want to dive into the world of revolutionary trading algorithms?

Head here where I unlock the secrets of AMMs.

Liquidity is created by users contributing their funds to the pools, which serve as the trading reserves. Liquidity pools, the backbone of DEXs, are formed when users contribute funds to the pools, providing liquidity for trading.

Each pool contains paired assets, and liquidity providers deposit an equal value of both assets into the pool to maintain balance.

As trades occur, fees are charged, and these fees are distributed to the liquidity providers based on their contribution. Traders interact with the liquidity pools to execute trades, and the AMM algorithms adjust the pool reserves, affecting asset prices based on supply and demand dynamics.

Liquidity pools enhance market efficiency, facilitate continuous trading, and provide decentralized access to liquidity. They offer opportunities for users to contribute assets, earn rewards, and improve overall liquidity in decentralized markets.

Want to know more about LPs?

Head over here and discover the depths of liquidity pools.

Understanding the liquidity distinctions between CEXs and DEXs helps shed light on the unique characteristics and dynamics of both exchange models.

Even though DEXs are obviously unique and help to create the decentralized finance (DeFi) section of crypto, how do they operate in the current regulatory environment?

DEX Regulatory Compliance

It seems like everywhere you turn today, there is talk about governments creating laws to regulate the cryptocurrency space.

Regulatory compliance poses unique challenges for DEXs due to their decentralized nature and the absence of a central authority.

As of now, the regulatory landscape for DEXs is still evolving, and specific regulations vary across jurisdictions. However, it is important to note that DEXs are not entirely exempt from regulatory obligations.

In some cases, existing financial regulations, such as anti-money laundering (AML) and know-your-customer (KYC) requirements, may still apply to DEXs, particularly when they interact with traditional financial systems or fiat on-ramps/off-ramps.

Additionally, some countries have introduced specific regulations for cryptocurrency activities, which can impact DEX operations. These regulations may cover aspects such as licensing, securities laws, consumer protection, and taxation.

However, the decentralized nature of DEXs can present challenges when it comes to enforcement and compliance. Since DEXs operate on blockchain networks, and employ smart contracts, it can be challenging for regulators to exercise direct control or oversight.

The absence of a central authority or a single entity responsible for the operation of the exchange can make regulatory enforcement more complex.

Continued advancements in blockchain technology have led to the development of hybrid solutions that aim to integrate compliance measures into DEXs.

These solutions may involve implementing off-chain components or utilizing identity verification protocols to enhance compliance with regulatory requirements while preserving the decentralized nature of the exchange.

It is worth noting that regulatory approaches and attitudes towards DEXs can vary significantly between jurisdictions.

While DEXs currently face challenges in complying with, and being regulated by, existing financial regulations due to their decentralized nature, the evolving regulatory landscape suggests that compliance requirements may become more defined in the future.

Depending what side of the fence you land on, the regulatory landscape can be a blessing or a curse. It becomes one of the points you need to consider when weighing the pros and cons of DEXs.

Pros & Cons of DEXs

CEX Advantages & Disadvantages

| Advantages | Disadvantages |

|---|---|

| Anonymity | Liquidity |

| Decentralized | Learning Curve |

| Non-Custodial | Smart Contract & Bridge Vulnerability |

| Permissionless | Unvetted Token Listings |

| Transparent | Limited Exchange Features |

| Censorship Resistant | Slower Transaction Speeds |

| Token Variety | High Gas Fees |

| Reduced Security Risks | Lack of Regulatory Clarity |

| Reduced Counterparty Risk | Limited or No Customer Support |

| Reduced Trading Fees |

DEXs offer a unique set of advantages and disadvantages.

On the positive side, DEXs prioritize user privacy by enabling direct wallet-to-wallet trading without the need for identity verification. This enhanced privacy ensures that user information remains secure and reduces the risk of hacking or security breaches associated with centralized exchanges.

Additionally, DEXs operate on blockchain technology, which guarantees transparency and immutability of transactions.

Furthermore, smart contracts automate trade execution, removing the need for intermediaries and fostering trustlessness in the exchange process.

However, decentralized exchanges also have their limitations.

One major drawback is the issue of liquidity.

Due to their peer-to-peer nature, DEXs often struggle to match the liquidity levels of centralized exchanges. This can result in fewer available trading options and wider bid-ask spreads, making it potentially more challenging to execute trades at desired prices.

Furthermore, the user experience on DEXs can be more complex compared to centralized exchanges. Interacting with smart contracts and managing private keys require a higher level of technical proficiency, which may deter less experienced users.

Additionally, DEX interfaces may lack the intuitive features and user-friendly design of their centralized counterparts, posing a learning curve for newcomers.

Considering the advantages and disadvantages of decentralized exchanges is crucial for users seeking to engage with DEXs. Individuals should carefully evaluate their priorities and their comfort level with the intricacies of decentralized trading before deciding to participate in DEXs.

Choosing Your Crypto Adventure

The comparison between centralized and decentralized exchanges reveals a range of considerations for crypto traders and investors.

Centralized exchanges offer convenience, high liquidity, and faster trading speeds, but at the expense of potential security risks, privacy concerns, and the need to navigate regulatory compliance.

On the other hand, decentralized exchanges prioritize security, user control over assets, and privacy, but may have lower liquidity and slightly slower trading speeds. Additionally, regulatory compliance remains a complex issue for both types of exchanges, with DEXs facing unique challenges due to their decentralized nature.

You should consider your specific needs and investment goals when deciding on what type of exchange is best for you. Ultimately, users should conduct further research, explore different platforms, and seek professional advice when selecting an exchange. By doing so, individuals can align their choice with their specific preferences and risk tolerance.

Remember, the cryptocurrency landscape is ever-evolving, and new technologies and solutions are constantly emerging. Stay updated on the latest developments, regulations, and user experiences to make well-informed decisions. Engage with the vibrant crypto community, seek advice from experts, and utilize reliable sources to enhance your understanding of centralized and decentralized exchanges.

Frequently Asked Questions (FAQ)

Q: What is a centralized cryptocurrency exchange?

A: A centralized cryptocurrency exchange (CEX) is an online platform that allows users to buy, sell, and trade digital assets. CEXs are operated by third-party companies which manage the user’s funds and assets.

Q: What is a decentralized cryptocurrency exchange?

A: A decentralized cryptocurrency exchange (DEX) is an online platform that facilitates peer-to-peer trading. DEXs are powered by blockchain technology and do not require a third-party to manage user’s funds or assets.

Q: What are the advantages of using CEXs?

A: CEXs offer convenience, high liquidity, fast trading speeds, and intuitive user interfaces. Additionally, they are more regulated and compliant than DEXs.

Q: What are the advantages of using DEXs?

A: DEXs prioritize security and privacy by allowing users to retain full control over their funds and assets. Additionally, they do not require users to submit their personal information.

Q: What are the disadvantages of CEXs?

A: CEXs can be vulnerable to hacking and other risks due to custodial management of funds. They may also have privacy concerns and face complex regulations.

Q: What are the disadvantages of DEXs?

A: DEXs have lower liquidity and slower trading speeds compared to CEXs. Additionally, they may be difficult to navigate for new users due to their decentralized nature.

Q: How do I choose between CEXs and DEXs?

A: Consider your investment goals and preferences when selecting an exchange. Research different platforms, explore user experiences, and seek professional advice to make the best decision for you.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page