Centralized Cryptocurrency Exchanges: Cracking The Code

Last updated on July 19th, 2023 at 05:26 pm

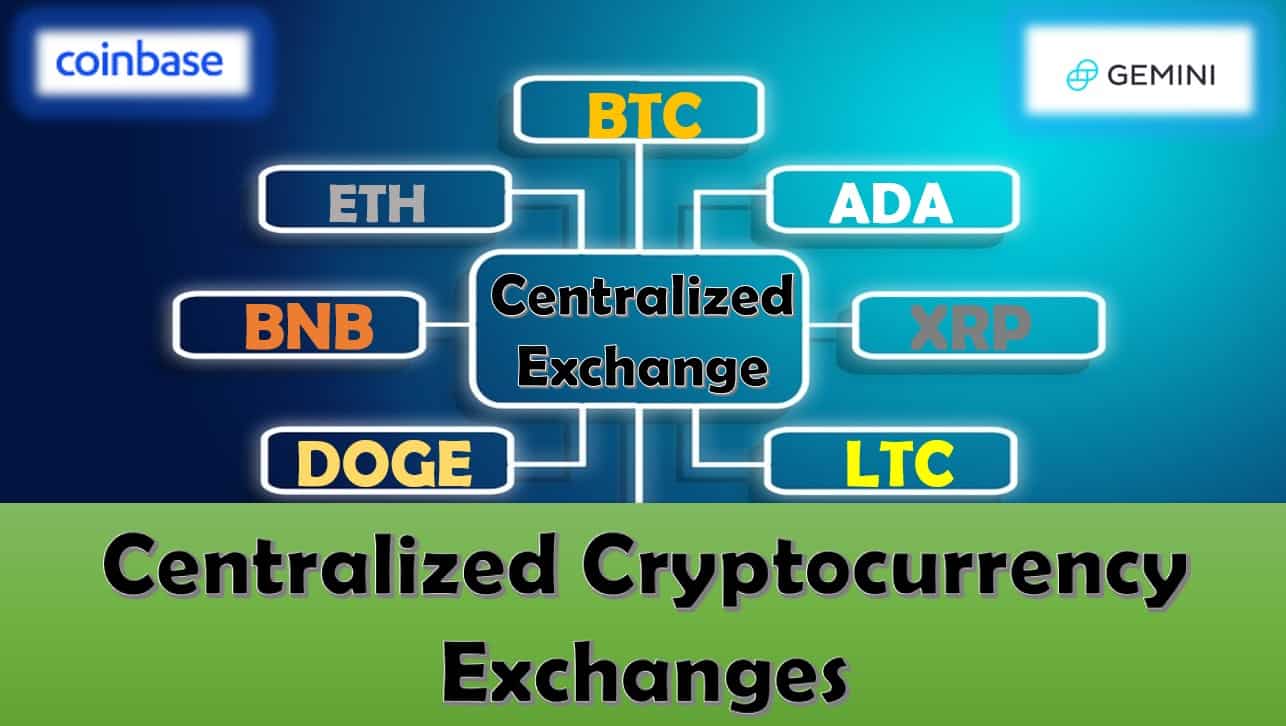

Anyone wanting to be part of the cryptocurrency space has to have the ability to buy, sell and trade various cryptos. Cryptocurrency exchanges are platforms that allow their users to do just that.

Some of the most utilized crypto exchanges are centralized in nature.

A Centralized Cryptocurrency Exchange (CEX) is a type of online platform where users can buy, sell, and trade cryptocurrencies. Centralized exchanges are operated by a third-party organization that acts as an intermediary between buyers and sellers. CEXs typically offer a wide range of services such as order matching, market making, and liquidity provision. These exchanges provide users with access to trading tools such as charting software, margin trading, and order books.

In this article we will focus on centralized cryptocurrency exchanges, how they work, as well as their impact on the broader cryptocurrency market.

Centralized Exchanges Table of Contents

Types of Crypto Exchanges

First things first, let’s define what a cryptocurrency exchange is.

Simply put, an exchange is a digital platform where you can buy, sell, and trade cryptocurrencies. These exchanges are a crucial part of the crypto ecosystem, as they provide liquidity and market pricing for various assets, making it easy for traders to make informed investment decisions.

However, besides understanding what cryptocurrency exchange is, you should also be aware of the different types of exchanges.

Generally speaking, there are two main types of exchanges; centralized and decentralized.

Centralized Exchanges

Though we are going to discuss centralized exchanges in greater detail in this article, let’s start out with at least an overview.

Centralized Exchanges (CEX) are online platforms that act as intermediaries between buyers and sellers. They are typically owned by companies or organizations who take responsibility for the security of user funds and the platform itself.

Decentralized Exchanges

Cryptocurrency purists would argue that a decentralized exchange is the way cryptocurrency was meant to function.

Frankly, they are not wrong.

But, sometimes you have to work with what you’ve got, until what you need is developed and completely user-friendly.

I talk more about this in my article dedicated to decentralized exchanges.

But for now, just know that Decentralized Exchanges (DEX) are peer-to-peer networks where users can trade cryptocurrencies directly with each other without the need for an intermediary. DEXs are usually built on blockchain technology which makes them more secure than centralized exchanges as there is no single point of failure or control.

Now let’s take a deeper dive into what a centralized exchange is and how it works.

What’s a Centralized Crypto Exchange?

A centralized exchange (CEX) is operated by a central authority, such as a company or organization.

They act as intermediaries between buyers and sellers, meaning that when you want to trade cryptocurrency on a CEX, you place an order with the exchange, which then matches you with a seller or buyer.

That sounds pretty simple right?

Ah, if only things were that simple…

Centralized exchanges serve a few different functions. Let’s take a look at how they work.

How Does a CEX Work?

First and foremost, these centralized exchanges facilitate trading by managing order books.

These order books are essentially just lists of buy and sell orders for various digital assets. Order books are used to match buyers and sellers, helping to ensure that everyone gets the best possible price for their trades.

Secondly, centralized exchanges manage user accounts. This means that they are responsible for holding and securing your funds.

When you deposit funds onto a CEX, your money is held in a wallet that is owned and controlled by the exchange. This includes the private keys to whatever crypto you deposit on that exchange.

Understanding this concept is very important… remember…

Not Your Keys, Not Your Crypto

This means that you need to trust the exchange to keep your funds safe. So it’s crucial to choose a reputable, regulated exchange with a good track record for security.

Finally, centralized exchanges help provide market pricing for cryptocurrencies, meaning that they help to determine the value of different digital assets.

This is done through a process known as price discovery, which involves aggregating buy and sell orders to find a fair market price.

As we can see, centralized exchanges play an integral role in the crypto ecosystem. But, how does this affect the adoption of crypto by the public?

CEX Role in Mass Adoption

Let’s start by addressing the elephant in the room… the lack of cryptocurrency adoption.

Cryptocurrency adoption has been slow due to numerous challenges. There has also been little need in many parts of the world until recently.

However, where the need exists, adoption is beginning to take place. We are able to clearly see this on the continent of Africa.

Moreover, this slow move toward crypto adoption is also caused by such things as the lack of technical know-how, trust, price volatility, and security concerns.

In fact, many people have yet to jump on the crypto train because it can be confusing and intimidating.

But, fear not my friend… CryptoCoinMindSet is here!

Spreading the word about and understanding of cryptocurrency is why I’m here.

Hopefully this blog is a big part of your crypto education. But, be sure to also visit my YouTube channel for more great info.

OK… time to get back to CEXs and mass adoption…

Because many people are used to the idea of having someone help them with their money, like a bank, the idea of a centralized exchange doesn’t seem all that foreign a concept.

Besides offering fiat on and off ramps to the crypto space, they’re essentially the middleman in the world of digital assets, providing a simple and convenient way for people to invest in crypto.

Another plus for centralized exchanges when it comes to mass adoption is their user-friendly interfaces. Buying cryptocurrency with a centralized exchange is as easy as clicking a few buttons. You don’t need to be a tech genius to figure it out.

Real-time cryptocurrency trading options and deep liquidity pools will also help to facilitate growth and adoption. What’s more, centralized exchanges also provide a range of services that will likely be attractive to newcomers.

However, for true crypto adoption, businesses, institutions and governments will also need to be onboard.

CEX Role in Institutional Adoption

As we all know, one of the challenges faced by businesses and institutions looking to invest in cryptocurrency is the lack of regulatory clarity. Without clear regulation, it can be risky for these entities to invest significant amounts of money into digital assets.

This can clearly be seen in this article where I report on one aspect of this ongoing regulatory debacle.

But how can centralized exchanges help with this issue?

In theory, centralized exchanges can serve as a bridge between businesses and the cryptocurrency world.

Because CEXs are regulated, especially in the U.S. and EU, they can provide a secure platform for buying and selling cryptocurrencies. This can make it much easier for institutions to navigate the crypto landscape.

One of the most significant benefits offered by centralized exchanges for institutional investors is over-the-counter (OTC) services.

OTC services allow businesses and institutions to buy and sell large volumes of cryptocurrency without impacting market pricing. This is critically important for institutions looking to make significant investments in cryptocurrency as it allows them to enter and exit positions without having a significant impact on the market.

Another significant benefit offered by centralized exchanges is custodial services.

Custodial services provide additional security for institutional investors by allowing them to store their digital assets with a trusted third-party. This is also crucial for businesses and institutions, who often have strict regulatory or security requirements.

It should be noted that even the major players in the traditional finance sector (TradFi) are beginning to develop their own OTC and custody service for their clients.

CEX Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| User-Friendly Interface | Centralized Control |

| Liquidity | Target for Hackers |

| Fiat On & Off Ramp | High Transaction Fees |

| Customer Service | Control Your Fiat & Digital Assets |

| Requires KYC |

CEXs For U.S. Residents

One thing is for certain when it comes to living in the U.S. and accessing cryptocurrency… it is getting more difficult by the day.

As regulatory uncertainty continues, people living in the U.S. are slowly being shut out. Thus limiting the number of cryptos they can buy, sell or trade.

While this section is not meant to be a deep dive into the various crypto exchanges still available to the U.S., that information is available here.

Let’s take a quick look at the top U.S. exchanges.

Coinbase

Coinbase is one of the oldest crypto exchanges in existence today… and frankly, as centralized exchanges go, one of my favorites.

It offers a variety of digital assets which are easily accessed through an extremely friendly user-interface. This makes their exchange the perfect choice for beginners.

Coinbase also has excellent security measures in place to protect their users from theft.

And, if you’re looking to learn more about cryptocurrency, Coinbase offers opportunities to learn and earn.

Furthermore, Coinbase also has an intuitive mobile app that allows users to trade on-the-go with ease.

All of these features come at a price. Coinbase has some of the highest fees of any centralized exchange available in the U.S.

Gemini

Founded in 2014, Gemini is a fully regulated and licensed exchange platform that operates in the United States, Canada, Hong Kong, Singapore, South Korea, and the United Kingdom.

The exchange was founded by the famous Winklevoss twins, with a mission to establish a strong and secure infrastructure for trading digital assets.

One of the most notable features of Gemini is their emphasis on security. The exchange is a New York State Trust Company, that is subject to strict regulatory oversight under the NYDFS.

Gemini has a user-friendly interface that is easy to navigate, making it a great choice for both beginners and experienced traders alike.

The platform offers a variety of digital assets available for trade including its Gemini dollar, which is a stablecoin pegged to the U.S. dollar.

Kraken

Kraken is another popular exchange for U.S. based traders and investors.

Kraken provides a reliable platform to buy and sell digital assets with low fees and high liquidity. Although it should be noted that the interface on this exchange is not quite as user-friendly as Coinbase & Gemini.

Kraken also offers advanced features such as margin trading, futures trading, staking rewards programs, and more for experienced traders looking to take their game to the next level.

Finally, Kraken is the only exchange in this list to be part of the TradFi system.

Binance.US

Binance US is another great option if you’re based in the United States since it only accepts customers from within the country’s borders.

This platform came into existence after U.S. residents lost access to the main Binance exchange.

Allowing access to only U.S. residents helps the platform navigate the ever changing regulatory landscape much more easily.

Binance US provides users access to all major cryptocurrencies on its platform. The fee structure is on par with those found on Coinbase and Gemini, however, the liquidity is a bit lacking in comparison.

However regulations, vague as they may be currently, reign supreme.

CEX Regulatory Considerations

Centralized cryptocurrency exchanges operate within a complex web of regulatory requirements. These requirements vary depending on the jurisdiction that the exchange operates in.

As we continue to see, the very nature of cryptocurrencies as a new asset class has been a cause of concern and confusion for legislators globally.

However, adhering to specific regulations is crucial to ensure investor protection, guarantee a well-functioning market, and promote stable growth.

One of the critical regulatory considerations for centralized exchanges is obtaining the necessary licensure.

In the United States, for example, exchanges need to be licensed as a money transmitter, a broker-dealer, or an alternative trading system. Without these licenses, centralized exchanges would face consequences such as heavy fines, legal complications or even being shut down by regulatory bodies.

As I mentioned earlier, another essential regulatory requirement is Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance.

These regulations require exchanges to conduct due diligence on their customers, including verifying their identities. By doing so, exchanges can prevent the use of their platform for illegal activities such as money laundering, terrorism financing, and other forms of illicit financial activities.

Data protection is also important for centralized exchanges. These exchanges must comply with data protection regulations, which means they must store users’ data securely and ensure it is not disclosed or misused.

For exchanges looking to operate efficiently, compliance with these regulations is necessary for the stability of the market, investor protection, and trust.

With increased regulatory scrutiny and enforcement, the future of the crypto industry is likely to be shaped by a more robust and well-defined regulatory landscape that will enable more participation in the market.

This will also help these centralized exchanges potentially increase their revenue.

CEX Revenue Generation

If you ask me, this is the one area where these centralized exchanges act just like the traditional banking system… fees, fees, fees!

The most common type of fees on a centralized exchange are through trading fees.

These fees are levied on every buy and sell transaction made on the platform. The typical trading fee for most exchanges is around 0.2% of the trade value, however, as in the case of Coinbase, they are as high as 0.5%.

So on a typical exchange, if you make a $100 trade, you’ll pay a $0.20 fee, but on Coinbase that same trade would cost you $0.50.

Other fees include withdrawal fees, deposit fees, and membership fees.

These membership fees for example will often provide frequent traders access to features like lower trading fees. Furthermore, tiered membership plans can charge higher fees for more significant benefits, such as access to expert support or prioritized trading orders.

Another way that centralized exchanges generate profits is through margin trading, leverage trading, and futures trading.

These involve contracts between the exchange and the trader where the exchange lends funds to traders, who use them to make larger trades. These trading methods typically result in higher fees for users and provide a more significant portion of an exchange’s revenue.

Another fee, which is aimed at the coin and token developers, is a coin listing fee. This is a fee charged to a project to get their asset listed on a particular exchange.

While this fee is usually exorbitant, the more exchanges a coin is listed on will often affect the price in a positive direction.

Ultimately, all of these can add up to generate substantial revenue over time.

It should be noted that while higher fees typically generate more significant revenue, they can also discourage users from trading on the platform, which could harm the exchange’s overall liquidity.

Balancing fee structures can be challenging, but it is essential to ensure the viability of the exchange itself.

CEX Conclusion

Centralized exchanges offer advantages including greater liquidity, fast transaction speeds, higher levels of customer service, and access to fiat currencies for trading purposes.

However, for those looking to use a centralized exchange, they should understand the potential risks. These risks include counterparty risk due to their reliance on third parties for custody of user funds, as well as potential manipulation by insiders due to their centralization structure.

Currently, centralized exchanges play a necessary role in the space. Their use could also be a catalyst for future adoption of cryptocurrency by the public as well as businesses.

Ultimately it is up to each individual user to decide whether the benefits outweigh the risks when choosing an exchange platform for buying, selling and trading cryptocurrencies.

Frequently Asked Questions (FAQ)

Q: What is a centralized cryptocurrency exchange?

A: A centralized cryptocurrency exchange (CEX) is an online platform that allows users to buy and sell cryptocurrencies for other assets such as fiat currencies or other digital assets.

Q: How do centralized exchanges work?

A: Centralized exchanges are run by a third party and provide users with an interface to buy, sell, and trade cryptocurrencies on a secure platform. Most centralized exchanges will also have order book systems to facilitate the matching of buyers and sellers.

Q: What are the fees associated with using a CEX?

A: Fees associated with using a CEX typically include trading fees, withdrawal fees, deposit fees, and membership fees.

Q: Is it safe to use a centralized exchange?

A: Although CEXs are more secure than their decentralized counterparts, they can still be vulnerable to security breaches due to their centralization structure. Additionally, since user funds are held by the exchange itself there is also some counterparty risk.

Q: What are the benefits of using a centralized exchange?

A: The primary benefit is the increased liquidity that comes with using a CEX due to it being run by a third party, as well as access to fiat currencies for trading purposes. Additionally, many CEXs also provide higher levels of customer service and faster transaction speeds.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page