5 Types of Crypto Wallets and How To Choose The Right One

Last updated on July 25th, 2023 at 07:44 pm

Cryptocurrency definitely has a learning curve. When I first started out in the crypto space in 2017, I assumed that cryptocurrency wallets would be one of the more simple things to learn. However, it quickly became obvious that I was still in for education when it came to cryptocurrency wallets.

The five types of cryptocurrency wallets are desktop, hardware, mobile, online, and paper. This actually refers to where these wallets are used. There are two categories of cryptocurrency wallets, hot (online) and cold (offline). These five wallets all fall into these two categories.

These two categories of cryptocurrency wallets provide various levels of access, control and security to your private keys. Your private keys are necessary to access and ultimately control your cryptocurrency.

I will share my experience to help demystify cryptocurrency wallets, make it easier to understand how they work and help you decide how to pick the best one for you.

Types of Cryptocurrency Wallets

As I mentioned earlier, there are two types of cryptocurrency wallets, hot wallets and cold wallets. All of the different wallets in use today fall into these two categories.

A hot wallet, also known as hot storage, refers to a cryptocurrency wallet that is online. This allows the user to access the wallet via some form of internet connection.

A cold wallet, also known as cold storage, refers to a cryptocurrency wallet that is offline. This allows the user to access the wallet without or with limited need for an internet connection.

There is another designation that applies to all cryptocurrency wallets. It is one of the major determining factors to consider when deciding what wallet you are going to use.

This designation is the determination if the wallet is custodial or noncustodial.

Custodial wallets, usually hot wallets, refer to someone, other than you, who controls the private keys to your cryptocurrency.

Noncustodial wallets, refer to you being the sole person in control of the private keys to your cryptocurrency.

Understanding this difference is critically important to your crypto journey… so much so, that I’ve dedicated and entire article to provide you greater clarity.

Please head here NOW and read it!

As I continue discussing cryptocurrency wallets you will discover that the space uses what we consider to be everyday terms, to describe certain aspects of the crypto space.

Sometimes these everyday terms in the crypto space are not necessarily analogous with what they are in real life.

Cryptocurrency and cryptocurrency wallets are a couple of those things.

When most people talk about a wallet, they picture a pocketbook or a physical wallet that we keep in our pockets that holds our cash and credit cards.

A cryptocurrency wallet, in actuality, does not hold our ‘physical’ cryptocurrency. It actually provides us a way to access our crypto which is on the blockchain.

For the purpose of this discussion, the blockchain is a distributed ledger on which transactions are recorded.

When we talk about cryptocurrency, people often think of cash or coins… heck, we even create physical coins to represent Bitcoin and other cryptos.

However, cryptocurrency is actually something completely different.

Public and Private Keys

At its most basic, cryptocurrency is nothing more than a private key on a blockchain. We use that private key to access that crypto by using our cryptocurrency wallet.

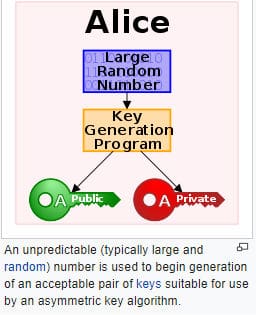

When we create our cryptocurrency wallet, two separate things are created at the same time, which are necessary, and work in concert with each other. The items created are a public and private key.

A public key is what you give out to someone so they can send you crypto. Think of it like your bank account number.

A private key is what you use to give you control over your crypto. Think of it like the login info for your bank.

When a private key is generated it is done so in the form of what is known as a seed phrase or a recovery phrase.

A seed or recovery phrase is a randomly generated set of words, usually 12 or 24 in total. This is what you need to back-up your cryptocurrency wallet.

These words, spelled correctly and used in the proper order, is what’s used to prove you are the owner of that wallet and thus gives you control of that cryptocurrency.

Be sure to keep this seed or recovery phrase in a safe location.

Perhaps more than one copy located inside of a fire-proof safe in different geographical locations. This will help protect your wealth in case of fire, flood or other catastrophic event.

SECURITY TIP: Never give your seed or recovery phrase to anyone. With it they can steal your cryptocurrency.

| Wallet | Category | Custodial/Noncustodial | Top Advantage | Top Disadvantage | Recommendation |

|---|---|---|---|---|---|

| Desktop | Hot | Noncustodial | Friendly User Interface | Malware/Viruses/Keyloggers | Exodus |

| Hardware | Cold | Noncustodial | Highly Secure | Learning Curve For Beginner | Ledger |

| Mobile | Hot | Both | Convenience | Only Secure as Your Phone | Trust |

| Online | Hot | Both | Newbie Friendly | Require Trusted 3rd Party | MetaMask |

| Paper | Cold | Noncustodial | Secure From Hackers | Loss/Theft/Degradation | None |

What Are Hot Wallets?

This is the largest group of cryptocurrency wallets available today.

These wallets are most often the first wallet a person new to cryptocurrency is exposed to. Case and point, cryptocurrency exchange wallets are included in this group of wallets.

Hot wallets are cryptocurrency wallets that require an online or internet connection to be accessed. These wallets can be either custodial or noncustodial in nature. This category of wallets includes online wallets, mobile wallets and desktop wallets.

Hot wallets have different points of access online. Let’s take a look at the different types hot wallets.

Online Wallets

Online wallets, also referred to as web or software wallets, are a cryptocurrency wallet that is accessed from an online browser.

There are a multitude of crypto wallets that fall into this group. Some of these wallets include exchange wallets and browser extension wallets, such as MetaMask.

Even within this group there are varying levels of control and security.

In general, this type of wallet is easy to set-up and use. They provide a simple user interface and easy access to your crypto. Transactions are simple and quick to complete.

It is this ease of access that often provides the greatest risk to the security of our crypto assets.

SECURITY TIP: When accessing anything crypto related online, you should use a VPN.

Understand why a VPN is a must here.

Cryptocurrency exchanges utilize this type of wallet. You log in to your account on the exchange and you can move your cryptocurrency within the wallets they provide for you.

PRO TIP: Never leave any cryptocurrency that you are not actively trading on a cryptocurrency exchange.

Cryptocurrency exchange wallets provide hackers with a juicy target. In a hacker’s eyes, a crypto exchange is a honeypot just waiting to be stolen.

Furthermore, an exchange wallet is a custodial wallet.

This means that the exchange controls your private keys, not you. So, when push comes to shove, they own your cryptocurrency.

Finally, when you want to withdraw your cryptocurrency, most cryptocurrency exchanges have to rehypothecate your assets held on their exchange. Basically this means that they are using a fractional reserve banking strategy.

So just like with your bank, if everyone tried to get their money from the cryptocurrency exchange at the same time, there would not be enough liquid assets to give everyone what is owed to them.

The other end of the online wallet spectrum would be a wallet like MetaMask. The MetaMask wallet is an extension that is added to your web browser.

Once installed, you can create a wallet (generate a public & private key) and use it to receive, store and send cryptocurrency. This is a noncustodial wallet, so you are in control of your private keys.

But one of the greatest risks with either of these hot wallets is that they connect to the internet. So, these crypto wallets are out there as a potential target for hackers.

Advantages & Disadvantages of Online (Web) Wallets

| Advantage | Disadvantage |

|---|---|

| Great For Crypto Newbies | Some Require Trusted 3rd Party |

| Ideal For Holding Small Amounts of Crypto | Potentially Vulnerable To Hackers |

| Easy To Access | Susceptible To Malware/Virus/Keyloggers |

| Complete a Variety of Transactions (Buy/Sell/Swap) |

Mobile Wallets

Mobile wallets are just like desktop wallets but for your cell phone. You add them to your phone like any other app and they function like online wallets.

We’ve all become accustomed to doing so much with our phones, but we often forget the potential vulnerabilities. With every app we load onto our phone, we hand over a whole new set of permissions and access.

Our phone is an electronic device, as such it is susceptible to hacks and viruses.

For a mobile based cryptocurrency wallet to be more secure, your cell phone would need to be encrypted.

I put together some security ideas for your phone, you can read about them here.

Advantages & Disadvantages of Mobile Wallets

| Advantages | Disadvantages |

|---|---|

| Convivence | Only as Secure as Your Phone |

| Easy To Send & Receive On The Go | Device Loss or Stolen |

| Susceptible to Malware/Virus/Keyloggers |

Desktop Wallets

A desktop wallet is one that is installed on your computer or laptop. Once installed, you can create a wallet and back it up just like all the others we have discussed thus far.

A desktop wallet uses encryption to store your private keys on your computer.

So, as you might imagine, there are several possible attack vectors here, which range from potential online hackers to an infection of your computer.

Whether or not you plan to use your computer for crypto, you should have good security on your computer.

I have written a post about using firewalls and antivirus protection to keep your computer safe. You can read about that here.

SECURITY TIP: If you’re going to use a desktop wallet, you should use a computer that is dedicated for nothing else beside accessing your cryptocurrency wallet

Advantages & Disadvantages of Desktop Wallets

| Advantages | Disadvantages |

|---|---|

| Free | Online When Your Computer is Online |

| Easy To Use | Only as Secure as Your Computer |

| Noncustodial | Loss/Theft/Damage of Device |

| Friendly User Interface | Susceptible To Malware/Virus/Keyloggers |

What Are Cold Wallets?

Cold storage is considered the safest way to store your cryptocurrency assets, especially for the long term. This becomes markedly important if you are looking to pass your crypto wealth to your children and grandchildren.

Cold wallets are cryptocurrency wallets that require limited or no internet connection to be accessed. These wallets are noncustodial in nature. This category of wallets includes hardware wallets and paper wallets.

There are different types of cold wallets. Let’s discuss those now.

Paper Wallets

Back when the cryptocurrency space was young, and the storage options for the crypto assets that existed was limited, using a paper wallet was one of the best options for keeping Bitcoin safe.

A paper wallet is a mechanism for storing cryptos offline. It is literally a paper used to write down the private key, QR codes or root seed phrase (recovery phrase) of multiple private keys for your crypto asset.

The fact remains that paper wallets don’t store the actual or physical Bitcoin, but it refers to the pattern (key) in which the asset owner uses to accesses their crypto assets.

At the time, paper wallets were secure and easy, just get your private keys on a piece of paper. Once you did that, you stored it in a safe place, like a fire-proof safe, and your Bitcoin was secure.

Paper wallets are still used today. When you use a Bitcoin ATM, you get a piece of paper with a QR code which contains your private key.

Even with this current day use of a paper wallet as a method of cold storage, it is certainly not the most efficient.

These ATM paper wallets are limited in their actual use.

The use of Bitcoin ATMs has increased in recent years and this increase is expected to continue. This rise is most prevalent in North America. You can read about that increase here.

The most notable drawback is that when you want to spend some of your Bitcoin, it is not possible to spend just a little bit, it’s all or nothing.

This has caused people who are unfamiliar with this to lose all of their Bitcoin.

Moreover, paper is still susceptible to loss. It can degrade over time and is also vulnerable to fire or theft.

Advantages & Disadvantages of Paper Wallets

| Advantages | Disadvantages |

|---|---|

| Free | Not Reusable |

| Noncustodial | Printer is a Point of Attack |

| Most Hacker Proof | Can’t Spend Partial Funds |

| Loss/Theft/Degradation Over Time | |

| Not Easy To USe |

Hardware Wallets

A hardware wallet is a physical device. It is usually a USB or smart card style device, some of which require batteries.

These hardware devices, like other crypto wallets, store your private keys in the form of a seed or recovery phrase.

They are not as easy to use as hot wallets and are currently the best option for storing cryptocurrency for the long term.

It is such a good option for storing long term crypto wealth, I dedicated an entire article to the subject. You can read it here.

The main characteristic of the hardware cold wallet is that it is not connected to the internet. Any transaction carried out online is transferred to the offline wallet and stored.

The major difference in how the hardware wallet functions in comparison to other wallets is that a hardware wallet signs every transaction with the private key in an offline environment.

This prevents the private key from coming in contact with any online server during the process of signing the transaction. The signing process used by these hardware devices prevents hackers from accessing the private key even if they come across the transaction.

Many cryptocurrency exchanges, especially decentralized cryptocurrency exchanges (DEX) are building in interoperability with hardware devices. This allows the user to stake a cryptocurrency on a DEX for example, without losing possession of their private keys.

Ledger & Trezor

An example of a hardware cold wallet is the Ledger or Trezor USB wallet. These devices use a smartcard to protect and secure the private keys. It works like a USB drive, but needs a computer and a chrome-based app to work offline.

However, in May, when Ledger announced the pending launch of it’s Recover service, it became obvious that a firmware update could contain code to extract Private Keys from the device.

While many give Ledger props for being forthcoming with this information, this could have been done without anyone’s knowledge because, as of the writing of this article, Ledger’s code is closed source.

I have added a video that includes two OGs in the crypto space, Andreas Antonopolous and Jameson Lopp who discussed this in a live stream event. I of course added my “2 cents” to help provide further clarity… take some time to watch this informative video.

The drawbacks to all cold wallets include the challenge of losing or damaging the device as well as it being a slower process to move your cryptocurrency because the device is not connected online.

SECURITY TIP: Be sure to make your purchase ONLY from the manufacturer of the hardware wallet and one with an open source code. You don’t want to trust your cryptocurrency to any other seller.

Advantages & Disadvantages of Hardware Wallets

| Hardware Wallet Advantages | Hardware Wallet Disadvantages |

|---|---|

| Most Secure Wallet Option | Not Ideal For Day-to-Day Transactions |

| Almost Impossible To Hack | Learning Curve For Beginners |

| Stores Crypto Offline (air gapped) | Device Can Get Lost or Damaged |

| Ideal For Long Term HODLing | |

| Wallet Restorable With Seed Phrase | |

| Can Stake Assets With Compatible Sites | |

| Some Wallets Have Bluetooth Connectivity |

Choosing The Best Wallet For You

Deciding what cryptocurrency wallet is best for you mostly depends on what you want to accomplish with it.

The key determining factors when deciding on what wallet is best include:

What are you doing with your cryptocurrency?

How long will it be stored?

Are you going to be using your crypto for paying bills or trading?

Do you want to be in control of your private keys?

Honestly, all of the questions and many more are likely swirling around in your head trying to figure out the best wallet option for you.

Believe me, I understand.

I was in the same position multiple times during the course of my crypto journey.

Let me make a few wallet suggestions looking at some of these questions. This will give you a starting point to decide what is best for you.

Long Term HODLer

A hardware wallet would be best for this.

They are the most secure long term storage option and it has the added bonus of being noncustodial, so you are in charge of your crypto.

If you are looking to hold your crypto for the long term, you want to be in control of your private keys and you want your crypto to be as secure as possible.

The hardware wallets I currently use and suggest are the Ledger and Trezor.

The Ledger often has family purchase options, so you can get multiple hardware devices for an excellent price.

Having multiple wallets is a good idea, so you’re not keeping all your crypto in one place. Not to mention that these devices do have storage limitations, so it’s a good idea to use more than one.

Again, this is important, so be sure to read the post that I’ve dedicated just to this topic. You can read it here.

Daily User or Trader

If you’re going to be using your cryptocurrency frequently or actively trading it, you are going to need easy access to your funds.

In these situations a hot wallet would likely be best. However, I would caution you to only keep the amount of crypto you need to complete your transactions and store your remaining crypto in a hardware wallet.

In most cases, if you’re going to be using your crypto like this, you would be looking to use a desktop or mobile wallet.

The wallet you end up selecting will also be affected by your choice of exchange or trading platform. Some wallets are made to interact more efficiently with certain platforms, so check for these interoperability as you choose a wallet.

If you are not required to use a custodial wallet, such as an exchange wallet for trading, we suggest you search out a noncustodial option so you can remain in control of your private keys.

One of the best multi asset, noncustodial desktop wallets we’ve used is the Exodus wallet.

If you need a mobile wallet option, you should consider Exodus mobile wallet or Trust wallet.

Related To Crypto Wallets

What is the safest Bitcoin wallet?

Bitcoin is the original cryptocurrency and if you are investing in crypto, BTC should be your largest held asset. Read About The Safest Bitcoin Wallet Here.

Can someone steal my crypto with my wallet address?

Keeping your crypto secure is one of the most important parts of being your own bank. Discover How Your Wallet Address Relates To Your Crypto Here.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page