Money 2.0: Grasping the Differences Between CBDC and Crypto

Last updated on June 8th, 2023 at 02:43 pm

Both CBDCs and cryptocurrencies have dominated headlines all over the world during the past months. For those outside of the financial establishment, it’s fair to say that they have even confused the heck out of folks.

And as their development, implementation and regulation continue to be rolled out to the public, the lines that separate them are starting to blur.

So, what’s the difference between a CBDC and cryptocurrency?

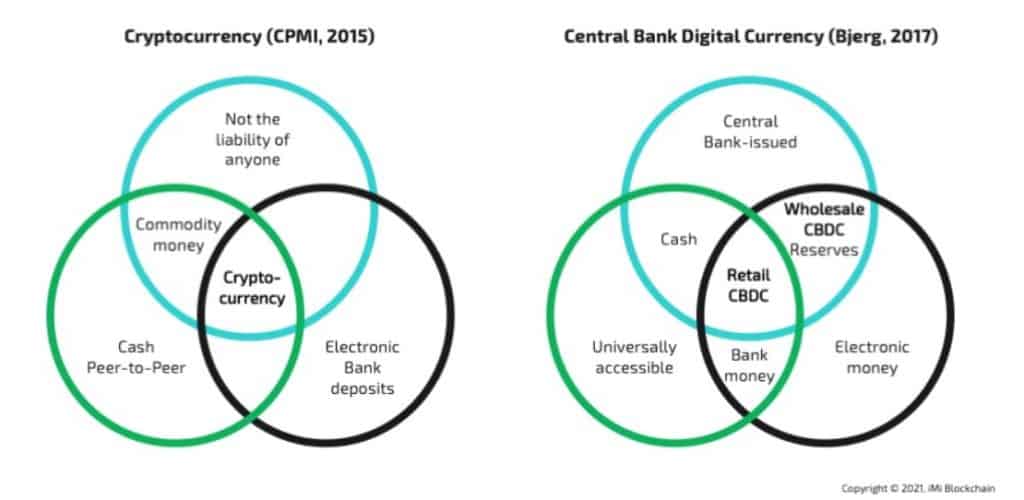

Central Bank Digital Currency (CBDC) and cryptocurrency are two classes of digital currencies that use blockchain technology, require a digital wallet and can be utilized for payments and trade. CBDCs are digital equivalents, pegged to a nation’s physical fiat currency. They are backed by government reserves, issued by central banks, and centralized by design to maintain control over the money supply and enact monetary policy. Cryptocurrency is decentralized by design, distributed across a peer-to-peer (P2P) network of computers. This allows users to transfer value without intermediaries or regulatory restrictions. Cryptocurrency is generally not pegged in price, so there can be extreme price fluctuations.

The debate between, and the understanding of CBDCs and cryptocurrencies is far from over.

It’s important to remember however, that despite using the same basic infrastructure, they are actually quite different.

As we explore the key distinctions between these two digital currencies, it will become abundantly clear that not only is one centralized while the other is decentralized, but because of this, each one comes with their own sets of benefits and drawbacks.

Let’s start out by understanding a little bit about each one.

CBDC & Cryptocurrency Clarity

What Are CBDCs?

It seems like everyday there is something new when it comes to banking and finance.

More and more, we are hearing the term, CBDC, Central Bank Digital Currency.

Heck, as of this writing, there are over 100 countries investigating, developing or using a Central Bank Digital Currency.

So, what are CBDCs?

Think of them as the regular fiat currency of a nation, but in a digital form.

These CBDCs are generally blockchain based, digital versions of traditional government-backed currencies. They are backed by the Central Bank reserves of their respective nation, so they are a liability of that respective Central Bank.

As such, CBDCs are built on a private, centralized, permissioned blockchain or other ledger.

So, in order to use this CBDC, much like the current banking system, you will be required to obtain permission to be part of, and operate within the system.

In a nutshell, CBDCs allow for instantaneous transactions and offer an extra layer of security as compared to traditional forms of payment. This is due to their permissioned blockchain-based infrastructure.

Depending on programming, they can provide additional control over the money supply. This can help to stabilize economies by providing easier access to capital and liquidity during financial crises, as well as force monetary policy upon the citizens of a nation.

But as with most things, there isn’t just one simple answer to a question.

Different Types of CBDCs

So, to muddy the waters just a little bit more, there is more than one type of CBDC. For the purposes of this discussion, we will focus on wholesale and retail CBDCs.

And while for the most part, the average citizen of any country utilizing a CBDC will need to only concern themselves with the retail version, it’s always good to at least have an understanding of everything.

With this thought in mind, let’s explore these two different types.

The first type, and the one that will be the most used by the average person, is the retail CBDC.

This will allow everyday citizens and businesses to make payments for goods and services.

The second type is a wholesale CBDC.

This type is generally reserved for larger organizations, such as banks and financial institutions.

Wholesale CBDCs typically have more stringent regulations and oversight as it is mostly used for settlements between countries and institutions.

Now that we have a basic understanding of CBDCs, the question is…

Why are governments and Central Banks wanting to make the change to a CBDC?

Afterall, we already make digital payments everyday… let’s take a look…

Why Central Banks & Governments Want CBDCs

Central Banks and governments are drawn to CBDCs like a moth to the flame… they’re simply too irresistible!

With more control over the money supply, easier access to capital during times of crisis, and an extra layer of security that physical currencies can’t offer… who wouldn’t want this digital dream?

But it’s not just control and security that are making CBDCs so attractive, they’re also allowing us to take the concept of money into the future.

By replacing the existing, archaic TradFi system with an updated form of digital payments, the benefits are plentiful. At the forefront of these benefits is quicker settlement times for consumers and institutions alike.

Not only does this make life easier for consumers and businesses, but it also helps Central Banks offer a secure form of payment that is backed by the government and monitored in real time.

Ultimately, CBDCs represent a revolutionary step forward in digital currency technology that can help pave the way for a new, and potentially dystopian, era of financial services.

But what about their decentralized cousins, cryptocurrency?

What is Cryptocurrency?

I LOVE crypto… it’s who I am, it’s what I do!

So, it would be easy to go on and on about what crypto is, its future, etc.

Oh wait, I’ve already done that… need a deeper dive on cryptocurrency?

But for the purposes of this article, I’m going to try to keep it short and simple.

In summary, cryptocurrency is a revolutionary new way to buy, sell, and trade goods and services without the need for government-backed money or banking institutions.

Cryptocurrencies are digital assets that use cryptography and various consensus algorithms to secure transactions, generate new units of currency, and verify the transfer of funds.

Transactions are recorded on a public ledger called a blockchain. Each crypto either has its own blockchain or utilizes another one depending on its design.

Want to know more about blockchain?

This article I have written will help get you on your way!

By using a decentralized network of computers, cryptocurrencies make it easier to securely store and transfer money across the globe.

Much like CBDCs, cryptocurrency can be broken down into different versions. Let’s take a quick look at those.

Different Types of Cryptos

Cryptocurrency is a wild and exciting ride, with plenty of options to choose from!

And while many of these options are similar in nature and design, there are certainly unique differences… let’s look at our options…

Cryptocurrency can be broken into the following groups; coins, tokens, privacy coins, and stablecoins.

I have provided links to the in-depth articles I did on each type… you definitely want to familiarize yourself with each one.

Each cryptocurrency also has a community of supporters. Once you’ve decided what your favorite cryptos are, join up with their online communities on Twitter and Reddit.

As a matter of fact, you can join me on Twitter here.

So, whether you’re looking for the stability of Bitcoin or the zany fun of Dogecoin, there’s something out there for everyone.

Regardless which cryptocurrency you choose, it’s a good idea to do your research and understand how it works.

Now that we have a basic understanding of both CBDCs and cryptos, let’s dive into the differences between them.

Differences Between CBDCs & Crypto

When it comes to the core differences between Central Bank Digital Currencies (CBDCs) and cryptocurrencies, you can think of them like two siblings in a family.

They’re related but have their own distinct personalities.

Let’s take a look at some of the major differences between CBDCs and crypto.

CBDCs are issued by a Central Bank and backed by the respective government. This usually makes their price more stable. On the other hand, cryptocurrencies are not backed by any government, as such, their values can fluctuate wildly depending on market conditions.

CBDCs are also centralized so they are regulated by the government, while there is no central authority overseeing crypto. This means that CBDCs have certain rules and regulations associated with them, this can be a double edged sword. Cryptocurrencies, however, are decentralized and are governed by the code of a particular blockchain.

So if you’re looking for something reliable and stable (can you hear the laughter in my voice as you read this?) with government oversight but don’t want to give up the potential of digital currencies, CBDCs might be the way to go.

On the other hand, if you don’t mind working with speculative assets , don’t mind price volatility, then crypto might be right for you.

While my sarcasm may show through when speaking about wanting a government controlled and monitored CBDC vs a decentralized, privately owned cryptocurrency, we should consider the pros & cons.

Advantages & Disadvantages

When it comes to the advantages & disadvantages of CBDCs and cryptocurrencies, it’s like looking at two sides of a coin. While both offer up some appealing features, they also each come with their own drawbacks.

CBDCs on one hand, are centralized, issued by Central Banks and controlled by the respective government, so they can potentially be more stable in terms of price. On the other hand, because they are centralized and regulated, they can come with certain rules & regulations which could limit their usability, not to mention the complete lack of privacy.

Cryptocurrencies on one hand, are decentralized, they exist on P2P networks, so they offer decentralized ownership. This provides a certain level of user privacy not found with CBDCs. On the other, their prices can be extremely volatile which might not be ideal for those seeking stability.

Advantages & Disadvantages of CBDCs

| Advantage | Disadvantage |

|---|---|

| Increased Transactional Speed & Efficiency | Loss of Privacy |

| Reduced Costs to Banks | Centralization |

| Potential Financial Inclusion (Both) | Potential For Financial Exclusion (Both) |

| Portability | Requires Permission To Use |

| Scalability | Programmability |

| 24-7 Access | Increased Need For Cyber Security |

| Potential Legal & Regulatory Issues | |

| Discourages Savings & Investment | |

| Requires Digital Wallet | |

| Banking System Disruptions | |

| Necessary Learning Curve |

Advantages & Disadvantages of Crypto

| Advantage | Disadvantage |

|---|---|

| Privacy | Price Volatility |

| Decentralization | Requires Digital Wallet |

| Permissionless | Necessary Learning Curve |

| Financial Inclusion | |

| Highly Secure | |

| Trustless | |

| Instant Remittance | |

| No Governmental Control | |

| Encourages Savings & Investments | |

| 24-7 Access |

Overall, both CBDCs and Cryptocurrencies offer up unique advantages & disadvantages that make them appealing to different types of users.

After understanding these pros & cons, you have to wonder about the future of these digital assets.

Future of CBDCs & Crypto

No matter how much I would like to think I can predict the future, I really don’t have a crystal ball and I am ultimately just guessing about what is to come.

But, it is possible to look at current circumstances and attempt to project the ramifications of them into the future… at least the not too distant future.

The future of CBDCs and cryptocurrency is uncertain, but one thing is for sure, they will have a significant impact on the world economy in the coming years.

As the technology evolves and becomes more advanced, we could see a major shift from traditional currencies to digital ones as more consumers and businesses embrace these new forms of money.

If you want to learn more about the world’s move toward being cashless, start here.

No matter what the future holds, it’s clear that these digital assets will play an increasingly important role in the global economy.

Do one of these digital assets have to reign supreme, or can they live and work together in a future economy?

Can CBDCs & Crypto Coexist?

It’s like asking if a cat and a dog can get along… the answer is yes, but it takes some effort to make it happen!

The same goes for CBDCs and cryptocurrency. While there are many differences between the two, they both have a place in the future economy.

CBDCs are backed by a central authority, which gives them legitimacy and stability.

Cryptocurrencies, on the other hand, rely on open source technology and provide users with more privacy and control over their own funds.

Both of these digital assets have advantages that can be used in tandem to create an economy that is secure, efficient, and fair.

In order for CBDCs and cryptocurrency to coexist in a future economy, there needs to be open communication between governments and developers, as well as strong security measures put in place to protect users and their assets.

It’s easy to extrapolate from current circumstances that the future of the global economy is uncertain. But one thing is for sure, CBDCs and cryptocurrency are here to stay.

As long as both sides can come together to find common ground, these two digital assets could be a powerful force that helps shape the world.

CBDC & Crypto Conclusion

CBDCs and cryptocurrency offer a number of advantages & disadvantages that make them appealing to different types of users.

It is too soon to say which will reign supreme in the future, but it is clear that there is an opportunity for both assets to coexist in a secure, efficient, and fair economy.

With open communication and strong security measures, CBDCs & crypto have the potential to usher in a new era of financial freedom and stability.

The debate between CBDCs & cryptocurrency is one that will continue for years to come. The more knowledgeable we become, the better decisions we can make towards a secure and prosperous economy for all.

Frequently Asked Questions (FAQ)

Q: Is it possible for cryptocurrency and CBDCs to coexist?

A: Absolutely! While the two assets have their differences, they both have a place in the future economy. By having open communication between governments and developers, as well as strong security measures, these digital assets can be used together to create an efficient and secure world economy.

Q: Do I need a central authority to use CBDCs?

A: Yes, CBDCs are backed by a central authority which gives them legitimacy and stability. On the other hand, cryptocurrencies rely on open source technology for oversight and regulation.

Q: What are the benefits of using digital assets?

A: Digital assets (cryptocurrency) can offer more privacy and control over your funds, as well as quicker and cheaper transactions. They also provide users with access to a global market that is not bound by geographical boundaries or time zones. Read more about crypto potentially replacing paper money.

Q: Is cryptocurrency the future of money?

A: It’s too soon to tell! Cryptocurrency is definitely an important part of the future economy, but CBDCs may also have a role to play.

Q: What are some potential risks of using digital assets?

A: Digital assets are not without risk. Without proper security measures, users can be vulnerable to hacking, fraud, and theft. Additionally, fluctuations in the market value of digital assets can lead to financial losses for investors. Therefore, it is important for users to do their research and understand the risks before investing in any digital asset. Learn more about keeping your crypto safe.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page