Cryptos Considered To Be A Best Investment For Beginners

Last updated on July 25th, 2023 at 07:46 pm

It’s easy to get lost and overwhelmed when you look at the cryptocurrency space for the first time. As of the writing of this article there are over 12,000 different cryptos.

If you’ve started out with a Google search for the best crypto investments for beginners, you probably ended up seeing lots of other opinions before landing here. You probably also noticed that many of the opinions are qualified with something like “best for 2022” and the like.

You’re not going to find that kind of thing here. Because I understand what it is like to be starting out in this space.

“I have already made the mistakes… I have already lost the money… I have already invested in the projects that started out with such great promise and are now dead.”

-Keith, CryptoCoinMindSet

I am here to share my experience in the hopes that it will prevent you from feeling that same pain. When you are starting out in this space, you need things kept simple and you want to know the why and how.

Moreover, my experience tells me that while the crypto space is constantly changing, there are some things that are more bedrock, things that are more likely to continue into the future and help shape it.

If you’re interested in learning about my continuing journey and better understanding the tenor I’m taking with this article and this website, check out my About Page.

Let’s take a look at the 5 cryptos suggested for the crypto novice to consider for their beginning portfolio.

Initial Cryptocurrency Portfolio

We all have to start somewhere.

And if you’re just entering the cryptocurrency space, you want to put your money into cryptocurrency assets that will maintain your wealth and potentially increase it.

This is the direction I am headed with the crypto assets I have listed here.

However, in order for this to work, I’ve found you have to eliminate all of the noise from influencers and projects in the space, do your own research (DYOR) before you invest and ignore the short term price volatility.

This is a long term process.

This is not a get rich quick scheme.

Before we go any further, I’m going to ask you to use this article as it is intended. Make it a resource, a beginning point for your own research before you invest. Then it will be helpful to you on that long term horizon.

Before I list these crypto assets, remember, this is NOT financial advice, I am NOT a financial advisor. You need to do your own research (DYOR) before investing and don’t invest money you can’t afford to lose. The results that I have experienced does NOT guarantee you will have the same outcome.

People who know me, and know that I work and invest in cryptocurrency inevitably come around to ask me what they should invest in.

Just about every time they ask that question it is because they are looking for the quick buck.

But, I always take the time to explain to them that if I was just starting out again in crypto, knowing what I know now, this is what I would invest in.

Suggested Initial Crypto Portfolio

Bitcoin (BTC)

Some people might say that this is a blatantly obvious choice. Yet others would argue that BTC is old and slow, and there are so many better options.

Afterall, BItcoin was the first cryptocurrency created in 2008 by Satoshi Nakomoto. It is also currently the largest cryptocurrency by marketcap.

And while those things are true, there is more to this choice. Frankly, I come to new realizations everyday as to why holding BTC as my primary crypto asset is the right choice.

So, let’s start by understanding a little bit about Bitcoin.

Bitcoin is definitely the OG in the space, it has name recognition and a proven track record.

BTC is currently being invested in by many companies and countries. Currently, Bitcoin is considered legal tender in the country of El Salvador and is used there everyday for ordinary purchases.

Bitcoin is deflationary in nature, unlike our current fiat money. This means that over time, BTC will increase in buying power rather than decrease like the U.S. dollar.

These reasons, and many more for that matter, solidify Bitcoin into the fabric of our society daily. Learn more about the daily uses for Bitcoin here.

About Bitcoin

Some of the important points to understand about Bitcoin are:

- Bitcoin is a blockchain. In a nutshell, a blockchain is an open ledger on which all of the transactions that are conducted with BTC are listed. Anyone can see the ledger and the transactions recorded within each block. Blocks can not be altered due to the cryptographic nature of the blockchain and its verification process.

- Transactions on its blockchain are verified by a consensus protocol known as Proof-of-Work. This protocol is referred to as mining and the people who are taking part in it are called miners. They use very powerful computers to solve highly complex mathematical equations. The mining pool (group of miners) that is the first to solve this equation is awarded BTC for verifying the transactions in that block.

- Bitcoin is decentralized. In a nutshell, this means a copy of the blockchain is located in the computers of all of the mining pools. There is no central point for someone to attack such as there is with your bank.

- Bitcoin is considered peer-to-peer money, this allows people to send money to each other without the need for a trusted third party, like a bank.

- Bitcoin maintains its deflationary nature by a process called a Halving. This means the payout for mining BTC is cut in half. This occurs approximately every 4 years.

- Currently, BTCs biggest drawback is its price volatility. However, if you consider this a long term investment as we’ve talked about, there is little worry over daily prices.

Why Bitcoin In The Beginner Portfolio

This is the primary asset in my initial portfolio due to its longevity and increasing adoption. BTC makes up approximately 50% of my initial portfolio.

Ethereum (ETH)

This is another cryptocurrency that some may say is also an obvious choice, but again, that is probably because they are looking for the big payout.

Currently, ETH is the second largest crypto by marketcap, however, we believe that Ethereum has a bright future because it has already made so many inroads into economies and companies around the world.

Through the Ethereum Foundation, ETH provides opportunities for development on the blockchain. While these developments are not always published by major companies involving themselves with this blockchain, some, like Microsoft are.

As investors go, Ethereum remains one of the most sought after crypto assets for the long term.

Ethereum differs from Bitcoin in that ETH is a network that allows for developers to create other cryptos, dApps and more by the deployment of something called Smart Contracts.

About Ethereum

Some of the important points to understand about Ethereum are:

- Like BTC, the Ethereum blockchain is open, so the main chain transactions are visible.

- Ethereum started using a Proof-of-Work consensus algorithm. In September 2022 it merged and transitioned over to Proof-of-Stake. In a nutshell, the PoS consensus algorithm allows for people, referred to as stakers, to hold ETH in a staking wallet and earn dividends for verifying the transactions on the blockchain.

- Ethereum provides stakers (investors) the ability to receive dividends for staking their ETH.

- Ethereum is a network for developers. It provides access to the developing blockchain technology as well as the security of the blockchain itself.

- The Ethereum blockchain uses ETH as ‘gas’ to move transactions on the chain. Think of the transaction as a car. That car needs gas to get where it’s going. ETH is that gas.

- Currently high ETH gas fees and slow throughput are the biggest cons to the Ethereum network. These issues are hoped to be improved after the merge.

Why Ethereum In The Beginner Portfolio

Ethereum is in my initial portfolio because of its current status as the Layer 1 blockchain for developers already having many projects built on top of it. Also its future as a development layer of decentralized dApps and protocols. ETH makes up approximately 15% of my initial portfolio.

Cardano (ADA)

Cardano is one of the cryptocurrency projects we have followed for years. It is a network for developers, very much like Ethereum. As a matter of fact, it was founded by one of the original co-founders of Ethereum, Charles Hoskinson.

Cardano has taken a long time to be developed, as of this writing, it is still being developed. Cardano has taken a very scientific based approach to the development of its blockchain.

This has caused delays in their timeline over the years and often brought scrutiny to the project.

However, even with these delays, Cardano is one of most developed blockchains currently in existence.

They have committed to bringing blockchain technology to the underdeveloped areas of the world. This will help to bring them into the global economy as most of these developing areas are currently unbanked or underbanked. This is a positive direction for the world, check out our discussion about that.

About Cardano

Some of the important points to understand about Cardano are:

- Like our previous blockchains, the Cardano base blockchain is open and able to be viewed by anyone.

- Transactions on the blockchain are verified by Proof-of-Stake. Cardano utilizes a variation of PoS called Delegated Proof-of-Stake (DPOS). In a nutshell, this DPoS algorithm allows owners of ADA to delegate those assets to a staking node (like miners in PoW) of their choice without losing possession of their ADA.

- Cardano provides stakers (investors) the ability to receive dividends for staking their ADA. Watch our videos on ADA staking here.

- Cardano is a network for developers. It provides access to the developing blockchain technology, increased throughput as well as the security of the blockchain itself.

- The Cardano blockchain uses ADA as ‘gas’ to move transactions on the chain, similar to the way the Ethereum blockchain utilizes ETH.

- Currently the major cons for the Cardano blockchain is its slow development which means decreased functionality with smart contracts.

Why Cardano In The Beginner Portfolio

Cardano is in the initial portfolio because of the painstaking lengths being taken to be forward looking in the development of its blockchain. Moreover, its positive world focus as well as the ability to earn a passive income with ADA make it a must have. ADA makes up approximately 15% of my initial portfolio.

Chainlink (LINK)

Chainlink is a decentralized Oracle network.

In a nutshell, an Oracle is software that provides information to other software applications, such as financial and insurance applications, to allow for them to function properly and accurately.

Chainlink takes this type of information and brings it onto the blockchain in a decentralized nature.

This allows blockchains to access real world data when necessary, providing the smart contracts the information they need to execute properly.

As the businesses and industries across the world move to blockchain technology, the need for bringing these off-chain resources onto the blockchain becomes vital.

The need for this is so great that many analysts consider the future of Chainlink better than that of Bitcoin.

About Chainlink

Some of the important points to understand about Chainlink are:

- Chainlink is a decentralized Oracle blockchain.

- Provides a critical service to developers on the blockchain by giving them a means of bringing real world and off-chain information to smart contracts in a decentralized manner.

- Chainlink continues to increase their number of partnerships with business inside and outside of the crypto space. Including providing real time price data to cryptocurrency exchanges and teaming up with companies like Arbol and Tezos.

- The current drawback is that this decentralized oracle technology is still very new. The integration of Chainlink oracles often requires individual development for proper individual blockchain integration.

Why Chainlink In The Beginner Portfolio

Chainlink is a part of my initial investment portfolio because there currently a real world need for oracle information in all aspects of the economy. Having the ability to bring information to a decentralized blockchain will be critical in the future. Chainlink is currently the leader in this area. LINK makes up approximately 10% of my initial portfolio.

Avalanche (AVAX)

Avalanche is designed to be a blockchain for the development and deployment of digital assets.

Like Ethereum and Cardano, Avalanche uses its AVA blockchain to allow developers to create while providing a means for assets still outside of the blockchain to plug in and interact with others in the network.

Avalanche has much faster transaction throughput than Ethereum and uses a consensus protocol called Avalanche Consensus.

Avalanche is using this speed to provide a place for building of the Metaverse and Web3 properties.

About Avalanche:

Some of the important points to understand about Avalanche are:

- Avalanche is a blockchain developed to provide a place for the exchange of global assets. With the use of smart contracts this can be accomplished while still maintaining regulatory compliance.

- Avalanche allows for developers to deploy sub networks on their blockchain, so customization is possible to allow for proper functionality. Think of it like a single network able to interact seamlessly with other, differing networks, creating a global market.

- Avalanche allows holders to create a passive income by creating a validation node and staking their AVAX.

- Avalanche is taking a leading role in the development of the Metaverse and Web3 technology.

Why Avalanche In The Beginner Portfolio

Avalanche is part of my initial portfolio due to its focus on creating an Internet of Assets (IOA), Metaverse and Web3 development. For those interested in passive income, AVAX also provides this ability. AVAX is approximately 10% of my initial portfolio.

So there you have my choices for an initial cryptocurrency portfolio. I have given you an overview of each as well as the why of my choice.

Again remember, be sure to DYOR before investing. This is meant to be part of that research.

What Do You Need To Invest In Crypto?

The quickest and currently easiest way to turn your fiat money into cryptocurrency is by using a centralized cryptocurrency exchange.

We will list our recommended crypto exchanges for U.S. residents below, but first we need to talk about what to expect when you use a centralized exchange.

Centralized exchanges have to operate within the purview of government regulators. This means that they follow most of the same laws and regulations as banks.

These regulations include Know Your Customer (KYC) and Anti Money Laundering (AML) laws. These regulations are why your bank makes you verify who you are by requiring a form of government issued ID as well as address verification.

So, the bottom line is, if you’re in the cryptocurrency space and wanting to maintain your anonymity, then using a centralized cryptocurrency exchange is NOT the way to go.

But, here we are going to discuss using a centralized cryptocurrency exchange to make your initial crypto portfolio a reality.

Open an Account

The first order of business is to open an account with the exchange you want to use.

Frankly, we suggest that you open an account with more than one exchange. This gives you access to more and different cryptos when you decide to make additional investments.

To open an account on a U.S regulated exchange you’re going to need a few things with you before you begin. These things include a valid form of identification and a bank account. You will be required to provide and verify each.

In most cases, a valid state issued driver’s license is adequate, but you can also use a passport.

You will need the routing number for your bank as well as your account number.

It should be noted that most of these cryptocurrency exchanges will allow you to use a credit/debit card as a means of funding your account on their platform. But, most require you to attach a bank account as the first and primary funding source.

The entire process of setting up and verifying a cryptocurrency exchange account for a retail investor takes between 3-5 business days.

A Cryptocurrency Wallet

Once you make your initial investment in cryptocurrency, you are going to need to secure your assets.

Remember, you need to keep them safe for the long term, so you need to put them into a cryptocurrency wallet.

One of the first, and honestly most important phrases in the cryptocurrency space is

“not your keys, not your coins”

– Andreas Antonopoulos

This phrase was first made famous by a crypto OG, Andreas Antonopoulos. You can watch his talk here.

Ultimately, you need to get your crypto off of whatever exchange you used to purchase it, and get it into your possession.

Think of it like your bank. You have money in the bank but, until you withdraw your money and put it into your wallet that you carry on you you really don’t have possession of your money. While your money is in the bank, the bank has possession of and ultimately controls your money.

I recommend you use a hardware wallet. This is a physical device, external device, separate from your computer or cell phone.

If you utilize good personal and online security procedures and create a gap to prevent wallet access you can secure your crypto portfolio.

This combination of security and this gap between your computer, the internet and your hardware wallet makes it extremely difficult for someone to get possession of your cryptocurrency.

I will be discussing security options for your crypto in upcoming posts, but for now, reading through our online security series will get you started.

There are two hardware devices that I use and recommend. I recommend the Ledger Wallet and the Trezor Wallet.

While the links provided for these are my affiliate links, I use both of these devices and recommend them to my family and friends.

While we will have more wallet related info coming your way, you can start out with our previous look at cryptocurrency wallets.

Recommended Cryptocurrency Exchanges

Choosing the best centralized cryptocurrency exchange to use depends mostly on the country you live in. The cryptocurrency regulations differ from country to country, so be sure to familiarize yourself with the laws in your jurisdiction.

The following recommendations are for those who live in the United States.

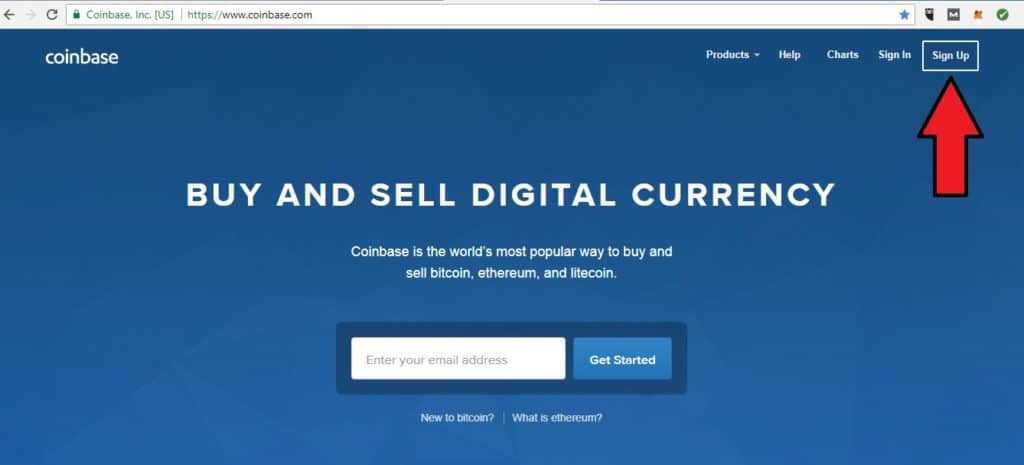

Coinbase

Coinbase is currently the largest U.S. based cryptocurrency exchange. They are very involved in the cryptocurrency space and are a publicly traded company.

Coinbase serves both retail and institutional clients. They provide trading as well as custody services for both.

Coinbase is diligent in its research into cryptocurrency assets prior to listing them on their exchange.

Currently, all of the assets listed in my initial crypto portfolio are available on Coinbase.

When you are ready to set up a Coinbase account, be sure to use my link (it is an affiliate link).

Once you fund and trade in your account, we will both receive some free BTC.

Gemini

Gemini is the second largest cryptocurrency exchange in the United States. They do however, have multiple offices across the globe including the UK and Australia.

This exchange was founded by the Winklevoss twins, who you may know from the founding of Facebook.

Gemini offers services for both retail and institutional clients. They also offer a credit card that pays your BTC rewards for your purchases.

Currently, only Bitcoin (BTC), Ethereum (ETH) and Chainlink (LINK) are available on the Gemini exchange.

When you are ready to set up a Gemini account, be sure to use my link (it is an affiliate link).

Once you fund and trade in your account, we will both receive some free BTC.

Kraken

Kraken cryptocurrency exchange is unique among its competitors.

Kraken is currently the only crypto exchange to receive a banking charter in the U.S.

Kraken is a bit less user friendly than Coinbase & Gemini, but it offers access to a wide variety of crypto assets.

Currently, all of the assets in my initial crypto portfolio are available on Kraken.

How To Make Your Cryptocurrency Investment

Once you have your account set up on the crypto exchange of your choice, making your investments is relatively easy. You just need to decide a couple of things.

How much money will you initially invest?

How will you make that initial investment?

Let’s talk about how much money to initially invest. That is a very personal choice and has a lot to do with your tolerance for risk.

Ultimately, every investment you make comes with a degree of risk.

Cryptocurrencies are among the most price volatile assets on the planet. Even though we are urging you to invest with a long term mindset, these price fluctuations can be concerning.

Consider starting out with what you can afford… $500, $1,000 or more. Most financial advisors will tell you not to invest more than 1-3% of the money you have earmarked for investments into crypto.

Regardless how much you decide to invest, that amount gets you started and you can always add to your initial portfolio over time.

Let’s talk about how to make your initial investment. We discourage people from making a lump sum investment into the market.

I suggest you consider dollar cost averaging (DCA) or as I prefer to say, crypto cost averaging (CCA).

I’ve broken it all down and show how this is an effective crypto investment strategy here.

How To Choose Investment Cryptos

While it is very exciting to get your initial investment set in the cryptocurrency space, the likelihood is high that you will want to invest more money into different crypto assets over time.

Frankly, I encourage this!

I believe that cryptocurrency is the future. I believe that it provides people across the world the means to create and then maintain their autonomy and freedom.

I don’t want to get on too much of a soapbox rant…

But I am hopeful that once you have immersed yourself in the space, that you will see and feel the same way.

So, how do you figure out what cryptos are a good investment?

This is a very astute question… let’s try to give you some direction.

You must commit to Doing Your Own Research (DYOR) on any project you are interested in investing in.

Doing this will take some time and commitment, but will ultimately be worth it in the end.

Some tips for DYOR include reading informative articles such as this. Once you find an influencer in the space you trust, like CryptoCoinMindSet, ingest their content wherever and whenever you can.

Staying informed is key to your success in the space.

Let CryptoCoinMindSet help you get your MindSet on crypto.

You can find all of our official social media channels here and you can sign up for our newsletter here.

Research using industry insiders, those who live and breathe in the crypto space day in and day out.

If you use resources outside of the space, even the more mainstream and seemingly reputable ones, their advice and understanding may not be as in-depth.

Binge on YouTube, read project white papers. Consider, what problem is this project trying to solve and, does it need solving.

Consider who is investing in the project… does it have adequate financial backing… is it flooded with venture capitalists… where is the money going when the profits start coming in and can early investors sell your potential profits right out from underneath you.

Dive into the project’s tokenomics. Understand what the use case is for the coin or token… understand what the numbers are, is it inflationary or deflationary… understand how it came into existence, was it premined… understand if it can create you a passive income.

We are fans of BitBoy, he is a great influencer in the cryptocurrency space.

In one of his recent videos he talked a bit about how he decides on coins he wants to invest in. He highlights a couple of different factors to consider, including one we mentioned briefly when talking about, why Cardano.

But know this, we use this factor every time we consider investing.

“Does a project or platform appear to be a good steward or will it be a project that does good for the cryptocurrency space, the United States in particular and the world as a whole?”

This is a critical determining factor for us.

You will find his video on this very interesting and engaging. You can watch it here.

By starting in these areas, you will ultimately find more resources to review and make a well informed investing decision.

Questions Related To Cryptocurrency Investing

What are the best places to hold your crypto?

There are many options when it comes to storing your cryptocurrency. Read About The Best Places To Store Your Crypto Here.

What are the top cryptocurrency wallets?

Understanding the best cryptocurrency wallets available for how you interact with crypto is important. Read About The Top Cryptocurrency Wallets Here.

Disclaimer

The information provided here is for INFORMATIONAL & EDUCATIONAL PURPOSES ONLY!

View our complete disclaimer on our Disclaimer Page